War in Ukraine and Risks of Stagflation

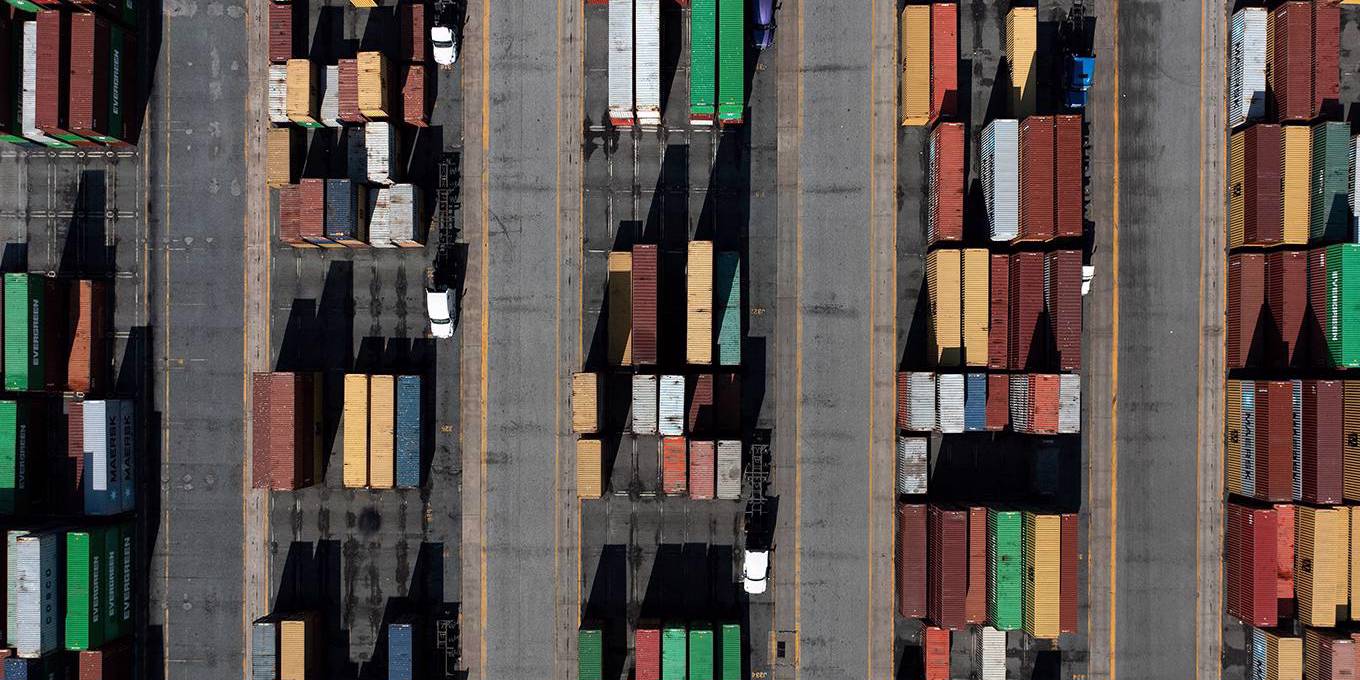

The war in Ukraine is bringing substantial financial, commodity price, and supply chain shocks to the global economy. Sanctions on Russia are already having a significant impact on its financial system and its economy. Price shocks will have a global impact. Energy and commodity prices—including wheat and other grains—have risen, intensifying inflationary pressures from supply chain disruptions and the recovery from the pandemic. The push toward relative deglobalization received from the pandemic will get stronger. One may expect an increasing weight of geopolitics in international payments and in the access to special commodities.