Since the 1950s, rapid growth has allowed a significant number of countries to reach middle-income status; yet, very few

have made the additional leap needed to become high-income economies. Rather, many developing countries have become

caught in what has been called a middle-income trap, characterized by a sharp deceleration in growth and in the pace of

productivity increases. Drawing on the findings of a recently released working paper (Agénor and Canuto 2012), as

well as a growing body of research on growth slowdowns, this note provides an analytical characterization of “middleincome

traps” as stable, low-growth economic equilibria where talent is misallocated and innovation stagnates. To

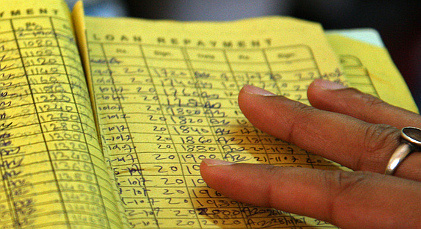

counteract middle-income traps, there are a number of public policies that governments can pursue, such as improving

access to advanced infrastructure, enhancing the protection of property rights, and reforming labor markets to reduce

rigidities—all implemented within a context where technological learning and research and development (R&D) are

central to enhancing innovation. Such policies not only explain why some economies—particularly in East Asia—were

able to avoid the middle-income trap, but are also instructive for other developing countries seeking to move up the income

ladder and reach high-income status.