Webinar : Political Economy in the North-South relations amid COVID-19

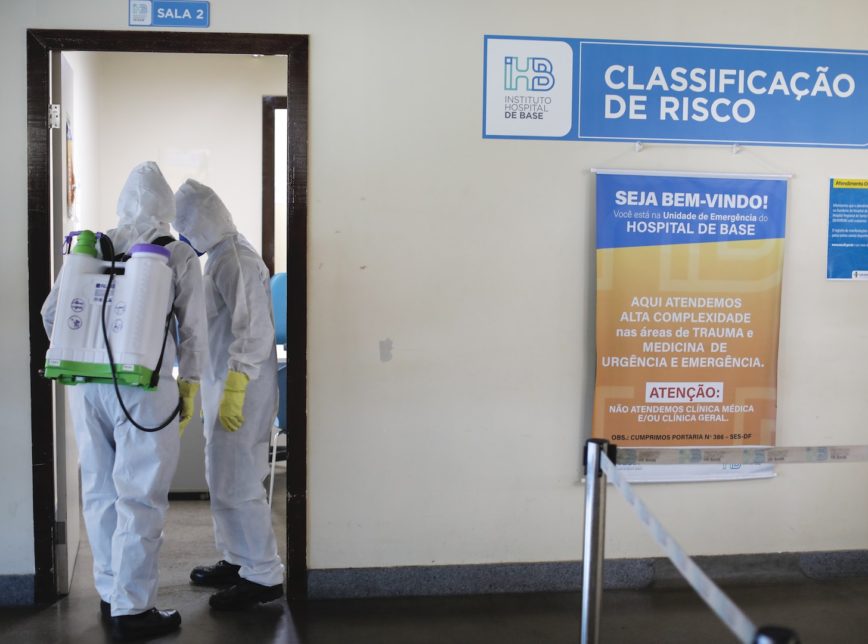

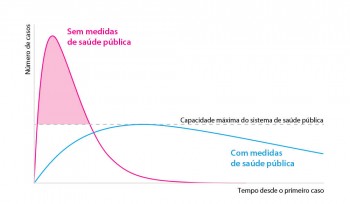

The COVID-19 pandemic poses unprecedented challenges to the international community and is due to heavily impact the global economy in the short and long run. The virus has infected over 4 million people and caused almost 300.000 casualties globally. During its spreading, mass production hastily witnessed shutdowns and supply chain disruptions, causing worldwide undulation effects encompassing all economic sectors. A steep contraction in household consumption, rising inflation and unemployment rates, and an abrupt halt in global tourism are some of its most visible consequences. Resilience of national economies vis-à-vis the current situation varies widely depending on many factors, including containment measures’ efficiency and effectiveness as well as the economic support governments consider deploying. Yet, the highly interconnectedness of the world means that fighting the virus – and navigating its economic consequences – must include both national measures and global ones. In this webinar, we reflect on alternative options for economic recovery. Trade agreements, debt relief measures, impact investments, green strategies – these are just some of the instruments available in the toolbox. The panel will address ways in which existing and new channels for cooperation between the global north and south can be leveraged to achieve the best possible way out of the crisis, with a long-term outlook on what kind of global economy we want to rebuild.