Policy Center for the New South, Research Paper 03-25, May 9, 2025

Sérgio R. R. de Queiroz; Nicholas S. Vonortas; and Otaviano Canuto

1. Introduction

Over the past two decades, Brazil has significantly expanded its R&D funding and incentive instruments. Despite this, total R&D spendingparticularly in the business sectorhas remained stubbornly low and stagnant. In parallel, the country’s innovation and economic performance throughout the 21st century has been underwhelming.

It is well known that Brazil transitioned from a period of extraordinary economic performance for much of the 20th century to a pattern of mediocre growth since the 1980s. This shift has positioned the country as a textbook case of the “middle-income trap” (MIT), as this paper will demonstrate.

Why, after years of government initiatives to promote R&D and innovation, have public policies proven so ineffective? Why, despite progress in several areas, is the country still unable to break free from the low-growth gap? These are the central questions this paper seeks to address.

There is a broad but inconclusive debate regarding the causes of Brazil’s economic stagnation over the past four decades. From macroeconomic instability and the role of the state to factors such as low investment in education, a wide range of explanations has been offered. However, this debate has yet to converge on a clear diagnosis or yield a coherent public policy agenda. Some critical elements remain overlooked in the existing literature.

We argue that significant global changes – particularly since the 1980s – have shaped Brazil’s current economic challenges in ways that have not been adequately addressed in global analyzes. Globalization, the rise of global value chains (GVCs), and the growing importance of technology-intensive entrepreneurship are key among these transformations.

This paper seeks to demonstrate how these international shifts, combined with enduring domestic issues, disrupted the trajectory of industrial and technological development that Brazil had followed since the 1930s. In essence, growth strategies that relied on the scale of the domestic market ceased to be effective. The innovation and economic challenges the country now faces cannot be resolved without a proper understanding of these evolving dynamics.

The analysis leads to specific policy implications, centered on the need for less protectionism and greater international integration of Brazilian firms. Reversing the inward-looking orientation of Brazil’s industrial sector is essential for any policy aimed at increasing business R&D and fostering innovation.

In addition to this introduction and the conclusion, the paper is structured into four main sections. The next section briefly reviews Brazil’s economic and technological performance throughout the 20th and 21st centuries, culminating in the country’s current position in the so-called MIT. The third section surveys the leading explanations proposed in the ongoing debate about Brazil’s economic stagnation since the 1980s. The fourth section explores global transformations that are often underestimated in analyses of Brazil’s innovation and economic underperformance. The fifth section presents an alternative explanation that integrates these international developments. Finally, the sixth section outlines a policy agenda aligned with the goal of overcoming the MIT.

2. The Past and Current Picture of Brazilian Economic and Technological Performance

2.1. The Innovation Failure

Since the late 1990s, science and technology policy in Brazil has made innovation a central priority. Beginning with the creation of the Sectoral Funds in 1999, followed by subsidy schemes and fiscal incentives to promote business R&Dsuch as the Green and Yellow Fund (2001), the Innovation Law (2004), and the Lei do Bem (2005)there has been a significant expansion in the number of instruments aimed at fostering innovation (IEDI, 2010).

More recently, initiatives at both the federal and state levels, including programs by the Research Foundation of the State of São Paulo (FAPESP) to support innovation-driven research, have reinforced this policy agenda. Overall, public policy in Brazil has consistently embraced the objective of stimulating innovation.

Despite these efforts, the outcomes have been disappointing. As shown in Table 1, there is little evidence to suggest that Brazilian firms are improving their innovation performance.

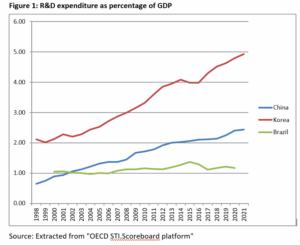

In addition, the subsidies and fiscal incentives intended to promote R&D do not appear to be effective. Figure 1 highlights the stark contrast between Brazil and two rapidly advancing technology economies: China and South Korea. At the beginning of the century, China’s R&D expenditure as a percentage of GDP was lower than Brazil’s. However, while Brazil’s innovation effort has remained stagnant, China has rapidly increased its investment and is now approaching the levels seen in OECD countries for this indicator (Canuto, 2011, ch. 11).

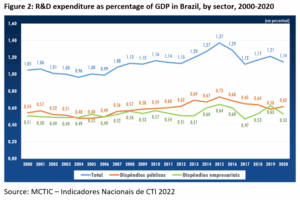

A closer look at the indicator in Figure 2 reveals two noteworthy points. First, as previously mentioned, R&D expenditure in Brazil has remained stagnant over the past two decades. The apparent peak in 2015 is misleading: it reflects a drop in GDP due to the recession at the time, rather than an actual increase in R&D spending.

Second, public R&D expenditure slightly exceeds business spending. Government investmentaround 0.65% of GDPis relatively robust and aligns with the average observed among OECD countries (0.67% for the 2015-2020 period). In contrast, business R&D expenditure in Brazil, at approximately 0.6% of GDP, falls significantly short of the OECD average of 1.83% over the same period.

The obvious question that arises is: why do companies in Brazil invest so little in R&D? Why, despite all the government’s measures to incentivize business R&D, has there been so little progress?

Two respected analysts of science and technology policy in Brazil have posed similar questions: why are public policies unable to motivate companies to invest more in technology and innovation? Why, after years of prioritizing innovation in public discourse, have the results been so limited? And why, unlike in many other countries, does private sector investment account for less than 50% of total R&D expenditure in Brazil?

They acknowledge that something is clearly not working—and emphasize that it is time to understand why and how to fix it (Pacheco & De Negri, 2022). To begin addressing these questions, we may need to rethink the focus of policy. Thus far, efforts have leaned heavily on the supply side—emphasizing measures to induce firms to invest in R&D. The demand side—creating conditions that make firms want to invest in R&D—has been neglected. As the old saying goes, you can lead a horse to water, but you can’t make it drink.

Before delving deeper into this issue, it is worth recalling why increasing business R&D is so important. Since innovation is a major driver of economic growth, stronger engagement by companies in innovation is essential for boosting productivity and long-term economic performance.

Economic growth depends on increases in total factor productivity (TFP) alongside capital accumulation. In turn, TFP gains reflect not only greater efficiency in resource allocation but also the accumulation and application of technological capabilities to innovate (Canuto, 2021). Technological learning—using, adapting, and innovating—is essential. R&D serves as a crucial input for innovation and, by extension, economic growth.

Thus, R&D is part of the solution to the longstanding challenge that has plagued the Brazilian economy since the 1980s: its relatively weak macroeconomic performance. Four decades of sluggish economic growth have created a vicious circle: a poorly performing economy discourages R&D investment and, in turn, hampers innovation and growth.

It is therefore useful to take a step back to gain a clearer picture of the economic and technological development process in Brazil over the past century.

2.2. Economic and Technological Performance: Past and Present

During the first three decades of the 20th century, Brazil’s economy featured a small industrial sector and a dominant primary sector, with coffee bean exports as the main driver of growth.

The price of coffee plunged in the 1930s due to the economic crisis in the U.S. and Europe, but Brazil’s response to this challenging scenario was notably positive. The country launched a rapid import-substitution industrialization process that advanced through various phases in the 1950s and 1970s, leading to impressive economic growth from the end of WWII through the 1980s.

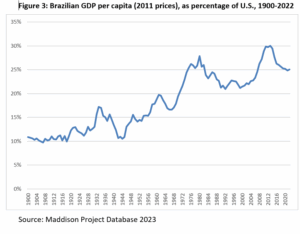

From that point onward, however, the story is very different. Figure 3 provides an overview of Brazil’s economic development during the 20th century and the two first decades of the 21st. As shown, from 1945 to 1980, Brazil’s per capita GDP relative to that of the U.S. rose from 11% to 28%. The setbacks of the following two decades seemed to be overcome in the 2000s, but we saw a reversal once again in the 2010s. The country now appears stuck at around 25% of the U.S. per capita GDP.

For a more focused view of recent times, Figure 4 compares the evolution of Brazil’s GNI per capita with that of East Asia and Pacific countries and other upper-middle-income countries since 1989. After an exuberant performance during the first decade of the century, Brazil’s GNI per capita has even declined in recent years.

According to Ipeadata, between 1940 and 1980, Brazil’s average annual real GDP growth at market prices was 7.0%. In the following forty years, up to 2020, this rate fell to just 2.0%.

It is easy to understand how the industrialization process that began in the 1930s fueled rapid economic growth in the subsequent decades. It triggered a structural shift in the composition of output—less agriculture and more manufacturing—while boosting overall productivity and accelerating economic growth. This is a well-known trajectory for economies transitioning from low to middle-income levels.

Technological development during this phase did not face major challenges. Imported technology—via machinery, services, and technology transfer contracts—was largely sufficient to meet the requirements of the manufacturing sector. The technology generated locally throughout the industrialization period was adaptive in nature, building on technologies already well established in advanced countries (Katz, 1987).

The abrupt slowdown in the 1980s clearly indicates the exhaustion of the import-substitution process and its failure to evolve toward more sophisticated levels of technological capability in process engineering, product engineering, and R&D within the manufacturing sector. The transition required moving from know-how capabilities to know-why capabilities, as Lall (1982) put it—or, in more contemporary terms, a leap from implementation to design capabilities (Lee et al., 2021), from imitation to innovation (Agenor & Dinh, 2013), and toward the development of a knowledge-based economy (Lee, 2013).

2.3. The Brazilian “MIT”

The sharp contrast in the economic performance of the Brazilian economy before and after 1980 has made the country a classic case of “MIT” (Canuto et al., 2024). The term “MIT” (MIT) broadly describes the experience of developing countries that successfully transitioned from low to middle levels of per capita income but then stalled, losing momentum on the path toward the higher income levels of advanced economies. This trap aptly characterizes much of Latin America’s experience since the 1980s and, in recent years, middle-income countries elsewhere have voiced concerns about following a similar trajectory. Underlying these concerns is a more general recognition: the climb up the income ladder becomes increasingly difficult the higher one goes (Canuto et al., 2020; Canuto, 2021).

MIT refers to the need for policy and institutional changes that enable a country to continue climbing the income ladder after transitioning from low levels. Traps are seen as the result of shortcomings—specifically, the absence of the policy and institutional reforms deemed essential for advancing from middle- to upper-income status. In most historical cases of successful transitions from low- to middle-income per capita, the underlying development process has followed a broadly similar pattern. Typically, a large pool of unskilled labor is moved from subsistence-level occupations into more modern manufacturing or service activities that require little skill upgrading but employ higher levels of capital and embedded technology. This technology, usually sourced from richer countries, is relatively easy to adapt to local conditions—as was the case in Brazil until the 1980s. The gross effect of this labor transfer—typically accompanied by urbanization—is a substantial rise in total factor productivity (TFP), meaning an expansion of GDP that exceeds what can be explained by increases in labor, capital and other physical production factors.

Reaping the gains from such “low-hanging fruit” in terms of growth opportunities eventually faces natural limits, after which growth slows and the economy risks becoming trapped at middle-income levels. The turning point in this transition typically occurs either when the pool of transferable unskilled labor is exhausted, or, in some cases, when the expansion of labor-absorbing modern activities reaches its peak before that exhaustion takes place.

Beyond this stage, raising total factor productivity and sustaining rapid growth becomes increasingly dependent on the economy’s ability to advance domestically—moving up the value chains in manufacturing, services, or agriculture into activities characterized by greater technological sophistication, alongside high demands for human capital and intangible assets such as design and organizational capabilities. The path from low- to middle- to high-income per capita reflects a progression: first, shifting the population from subsistence activities to simple modern tasks, and then from simple to more sophisticated ones.

Within-sector productivity gains and “moving up value chains” become more significant relative to the productivity gains from broad cross-sector structural change (Canuto et al., 2024). An institutional framework supportive of innovation and complex chains of market transactions is essential. Rather than simply mastering existing standardized technologies, the key challenge becomes building local capabilities and institutions—assets that cannot be imported or directly replicated from abroad. At a minimum, this requires providing quality education for the workforce and developing adequate infrastructure.

In Latin America, current middle-income countries experienced a slowdown in their labor-transfer processes from subsistence sectors before fully exhausting available labor surpluses. Macroeconomic mismanagement and inward-oriented policies until the 1990s imposed early limits on this transition. Nevertheless, some advanced enclaves along the value chain have emerged—for instance, Brazil’s technology-intensive agriculture sector, its sophisticated deep-sea oil drilling capabilities, and its expertise in aircraft design.

By contrast, Asian fast-growing economies have extensively leveraged international trade to accelerate labor transfers, primarily by integrating into the unskilled labor-intensive segments of GVCs. This strategy has been facilitated by advances in information and communication technologies, falling transport costs, and reduced international trade barriers. Together, these factors have enabled the fragmentation of production processes into chains of tasks with varying levels of sophistication, allowing geographically dispersed operations (Canuto, 2021).

Natural resource-rich middle-income countries face a distinct path. Unlike manufacturing, natural resource exploitation is largely idiosyncratic—each case shaped by its unique context. This creates significant opportunities for building local capabilities in sophisticated upstream and downstream activities, though doing so sustainably remains a critical challenge. Even in this context, an institutional framework that supports innovation, complex market transactions, advanced education, and the development of intangible assets remains indispensable.

The local development of capabilities for imitation and creative adaptation of existing technologies—followed by, or evolving alongside, innovation capabilities—is essential for raising productivity, upgrading employment, and moving up the income ladder. The effective application of technology requires locally embedded knowledge that cannot be fully acquired or transferred through textbooks or other codifiable means alone. This tacit knowledge is not easily made explicit, transmissible via blueprints, or perfectly diffused either as public information or private property; it must be cultivated locally. Production, technology adoption, and invention all require a relatively high level of such idiosyncratic knowledge and local capabilities (Canuto, 1995).

While technology originators typically progress from invention to adoption and production, latecomer economies often follow the reverse path: beginning with production and technological adoption, and only later advancing to invention. This pattern has been evident in countries like South Korea and China (Canuto, 2021, ch.11), where innovation capabilities emerged after extensive learning through the use and adaptation of existing technologies.

However, mere interconnectedness within global systems does not automatically generate productivity gains or local innovation. Success hinges on a broad set of complementary factors, including access to finance, robust infrastructure, skilled labor, and strong managerial and organizational practices. In the absence of these conditions, investments in capability development are unlikely to yield substantial returns (Canuto et al, 2010; Cirera & Maloney, 2017).

To address Brazil’s challenges, solutions must target market failures that disincentivize knowledge accumulation. However, the interaction between the private and public sectors must not obstruct the increasing density and complexity of transaction chains that accompany progression. Transaction costs associated with “doing business”—such as trading across borders, hiring workers and enforcing contracts—must be kept manageable. Likewise, other dimensions of the “investment climate,” including policy uncertainty, macroeconomic instability, corruption, crime-related losses, and infrastructure quality, must be favorable to avoid discouraging investment in capability development (Canuto, 2019). Broadly speaking, the incentive structure for economic agents must favor the pursuit of efficiency over the extraction of economic rents (Canuto & Ribeiro dos Santos, 2018).

While international trade and technology transfer are important accelerators of progress, long-term success also requires institutional reform, high-level education, and the local development of intangible assets. South Korea stands out as a prime example of a country that has fully exploited these opportunities to ascend the economic ladder.

It is also important to note that, especially in large economies, heterogeneity and diversity are inevitable. Brazil’s upper-middle-income status, as classified by the World Bank, conceals a dual economic structure that encompasses both high- and low-income activities and jobs. Overcoming MIT in such a context means not only advancing high-value sectors but also upgrades a significant share of overall employment, particularly by lifting low-income segments that were left behind in earlier phases of development (Canuto, 2019).

Traps may arise when upgrading becomes particularly difficult due to strong competition from incumbents in global markets. Gill & Kharas (2007) used the term “MIT” to describe economies that find themselves “squeezed between the low-wage poor-country competitors dominating mature industries and the rich-country innovators leading industries undergoing rapid technological change.” To a large extent, Latin America’s manufacturing sector was squeezed in this way by the significant influx of cheap labor into the global economy following the collapse of the Soviet Union and China’s integration into world markets.

Ultimately, however, the root causes of MITs often lie in local shortcomings—specifically, the inadequacy or absence of policies and institutions needed to support a successful upward transition. Agenor & Canuto (2015; 2017) developed analytical models showing how distorted incentives, talent misallocation, weak contract enforcement, insufficient intellectual property protection, limited advanced infrastructure, and restricted access to finance can trap a middle-income economy in a “bad” equilibrium characterized by low growth. Similarly, Aiyar et al. (2013) and Han & Wei (2017) highlight the negative growth effects of economies prone to frequent macroeconomic booms and busts.

In examining Brazil’s MIT, Canuto et al. (2024) analyze the country’s economic growth patterns over the past three decades, during which Brazil has experienced persistently low productivity growth and—apart from certain sectors—limited success in transforming its production and export structures toward higher value-added activities. Canuto (2023) describes this as a Brazilian “double disease”: a combination of chronic productivity anemia, and an oversized, inefficient public sector. In what follows, we outline several hypotheses that have been proposed to explain the causes of Brazil’s MIT.

3. The Inconclusive Debate on the Causes for Brazil’s Economic Slowdown

Since the 1980s—a period known in Brazil as the “lost decade”—debate has continued over the root causes of the country’s sluggish economic performance. Why did Brazil experience such a sudden and prolonged loss of economic dynamism?

We will now present, in a condensed form, the main explanations that have emerged in this debate.

3.1. Macroeconomic Instability

From 1966 to 1976, a period famously known as the “Brazilian Miracle,” the economy grew at an impressive average annual rate of 9.2% in real terms (Ipeadata). However, in the second half of the 1970s, the economic situation began to deteriorate. The first oil shock triggered a surge in inflation and, more critically, created a significant trade deficit, straining Brazil’s balance of payments. The military government at the time responded to these challenges by ramping up external borrowing, which culminated in a debt crisis in 1982.

With inflation spiraling out of control and serious difficulties in adjusting the balance of payments, there is little doubt that macroeconomic instability alone could serve as a key explanation for the “lost decade.”

In 1994, however, the Plano Real successfully brought inflation under control. Later, in the 2000s, the global commodities boom generated a substantial trade surplus and allowed Brazil to accumulate dollar reserves on an unprecedented scale, stabilizing the balance of payments for the first time in many decades.

Much remains to be done in terms of achieving full macroeconomic stability. Only very recently has the exchange rate begun to hover around an adequate level. The real interest rate remains among the highest in the world. The government continues to struggle with managing its fiscal deficit and keeping public debt under control. The economic crisis of 2015-16 is a striking example of how far Brazil still remains from achieving sound macroeconomic management and true stability.

Macroeconomic instability may partially explain the persistent lack of dynamism in the Brazilian economy. Even the so-called “developmentalists,” who offer alternative explanations for the difficulties in accelerating economic growth, have increasingly acknowledged its significance (Bresser-Pereira et al., 2016). As highlighted by Canuto et al. (2020), large swings in GDP and other symptoms of macroeconomic instability tend to raise the risk premia perceived by investors—including those investing in technological capabilities.

3.2. The “Neoliberal”/ “Interventionist” State

There is an ongoing and heated debate in Brazil regarding the role the state should play in fostering development. In a simplified view, there are the “developmentalists,” who argue that the main issue with the Brazilian economy lies in its embrace of neoliberalism, as represented by the Washington Consensus in the 1990s. According to this perspective, Brazilian economic stagnation results from the abandonment of developmentalist ideas in favor of the “neoliberal playbook” (Nassif, 2023).

On the other hand, liberal economists argue that excessive state interference was largely responsible for the missteps that hampered economic growth after 1980. They criticize excessive government spending and the distribution of incentives as tools to stimulate economic growth, as well as numerous active state policies with high costs and low effectiveness (Mendes, 2022).

While we are limited to stating the terms of the debate without exploring it in depth, it is important to consider a few facts. There is no doubt that the Brazilian state’s role has undergone significant changes over recent decades. During the 1990s, many public companies were privatized, and regulatory agencies were created. Some of these measures were reversed in subsequent governments. However, it is clear that the Brazilian state no longer wields the same level of influence over the economy as it did up until the 1970s. The shifting role of government is most evident in the evolution of the size and scope of operations of the National Bank for Economic and Social Development (BNDES) (Canuto and Cavallari, 2017).

Brazil, like many other countries, is still grappling with finding the right balance between state intervention and the freedom of the private sector to operate. Until the end of the Brazilian military dictatorship in 1985, the balance clearly leaned toward a strong state presence. This could seemingly lend support to the developmentalists’ argument that the state’s retreat in the 1980s and 1990s contributed to the economic slowdown. However, we believe this is not entirely the case. In fact, there is compelling evidence that privatizations and a reduced direct role of the state helped the economy operate more efficiently, though this was not enough to accelerate growth.

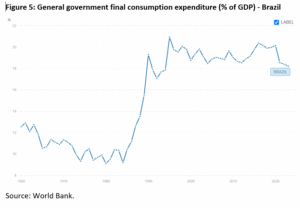

However, there is one key dimension of state intervention that should be considered as part of the low-growth issue: the nature of public spending. Since 1990, public spending has reached significantly higher levels than in the past (Figure 5). While this increase has partly been driven by the political desire to reduce poverty and income inequality through social spending, other areas of public expenditures, not directly tied to these goals, have also risen. These include generous pensions, subsidies, tax exemptions, and public-sector wages in top positions that surpass those in the private sector.

The quality of public spending has become a critical issue in this context. Despite the increase in spending, investments have remained at minimum levels necessary for maintenance over the past three decades. This underinvestment in infrastructure has had negative consequences, contributing to stagnated productivity growth and limiting overall economic progress (Canuto, 2023a; Canuto et al., 2024).

3.3. Low Investment in Education

Solow (1957) may not have been the pioneer of economic growth theory—an honor that belongs to Abramovitz (1956)—but his article had a profound impact on the field. From this point onward, the idea that growth depends fundamentally on increased productivity, rather than merely the accumulation of factors of production such as capital and labor, began to dominate neoclassical economic thinking.

The theory of endogenous growth (Romer, 1990) further solidified the notion in mainstream economics that innovation is the primary driver of economic growth—a concept Schumpeter had proposed more than 70 years earlier (Arcangeli & Canuto, 1996). Endogenous growth theory highlighted the role of human capital in fostering innovation, increasing productivity, and driving economic growth. Once the theory gained traction, a broad consensus emerged, reflected also in public policies, that investment in human capital is crucial for development.

A deeper analysis of how human capital came to occupy such a central role raises several important questions. For instance, Shelton (2023) argues that the growing emphasis on human capital is closely tied to a significant political shift in the United States, where the social democratic trajectory of the 1940s was abandoned in favor of transforming education from an economic right into the primary avenue for accessing economic opportunity. While the correlation between education and development is unquestionably strong, the direction of causality remains a matter of ongoing debate.

Brazilian authors of liberal background attribute a significant part of the explanation for the country’s economic underperformance to its historically low investment in education, especially basic education (Barbosa Filho & Pessoa, 2013). These authors emphasize the important role that investment in human capital plays in boosting productivity and reducing social inequalities.

The problem, however, is that while Brazil’s educational indicators have improved significantly in recent decades, the progress has been notable more in terms of coverage rather than quality. This trend is not unique to Brazil; much of Latin America has seen similar improvements in education, yet continues to deliver mediocre economic performance (Group of Thirty, 2023). Argentina, notably, stands out as a Latin American country with high educational levels for over a century but persistently poor economic outcomes. Conversely, there is broad agreement that rising levels of schooling have been a key factor in several successful income transitions in Asia and Eastern Europe (Canuto, 2021).

Investment in human capital is a necessary, though not sufficient, condition for sustained development. Given that this issue is one of the few areas where political consensus is relatively easy to achieve, Brazil should seize the opportunity to vigorously promote improvements in education at all levels. In fact, the country has been pursuing this path over the last three or four decades, and continuing at a faster pace—with a stronger focus on quality—remains an essential goal.

The economic slowdown from the 1980s onward cannot simply be explained by a deficit in human capital. In fact, Veloso et al. (2013) constructed an indicator to track the evolution of human capital from 1995 to 2022 and reported an 81% increase during that period, driven mainly by a significant rise in the education level of the Brazilian workforce. The reasons for Brazil’s weak economic performance, therefore, must be sought elsewhere.

3.4. Institutional Shortcomings

Transaction cost economics, which traces its origins to Coase’s seminal work (1937), advanced the study of the role of institutions in the development of capitalism (Williamson, 1987; North, 1990). Institutions—the rules of the game prevailing in society—reduce uncertainty and decisively influence economic performance by affecting both transaction and production costs.

Since the emergence of cliometrics in the 1960s and 1970s (North, 1973; Fogel & Engerman, 1974), our understanding of how institutions historically shape development processes has deepened. More recent and widely cited works have underscored the crucial distinction between inclusive and extractive economic institutions as a key factor separating success from failure across countries (Acemoglu & Robinson, 2012).

In Brazil there is a long-standing tradition—dating back to the works of Caio Prado Jr. and Celso Furtado—of linking development to institutions (Monasterio & Ehrl, 2015). In a theoretical review of economic development, Gonçalves (2013) highlights the strong correlation between productivity performance and institutional quality across a number of countries.

The challenge, however, is that no matter how many flaws can be identified in Brazilian institutions—and there are indeed many—it is difficult to interpret the country’s trajectory over the last four decades as one of institutional regression. In the 1980s, the country transitioned from a military regime, implemented a new constitution, and has since experienced peaceful transfers of power without setbacks through successive free and competitive elections. In short, the country has made political progress.

Institutions are likely central to another critical debate in economic literature: explaining the significant disparities in per capita income across countries. Improving its institutional framework is undoubtedly crucial for Brazil to achieve a higher level of development in the long run. As former British Prime Minister Gordon Brown wryly noted, “in establishing the rule of law, the first five centuries are always the hardest.” However, it is not clear that institutional shortcomings alone can account for the post-1980 economic slowdown.

There is, however, one aspect of Brazilian institutions that has clearly had a negative impact on productivity and economic growth: the “business environment”—that is, everything that occurs between the gates of factories, farms, and offices and the broader economy (Canuto, 2023a; Canuto et al., 2024). While some reforms, such as the new bankruptcy law and the upcoming tax system overhaul, have improved Brazil’s business environment in recent years, these measures are far from sufficient to make it truly conducive to efficiency and productivity.

3.5. The Failed Transition to a Knowledge Economy

As we have indicated, the extensive literature on the challenges faced by many middle-income countries in catching up with high-income nations offers useful insights into Brazil’s situation—at least in part. Most of these studies emphasize the critical need to acquire technological and managerial capabilities and to successfully transition to a knowledge economy, a step we also consider essential for accelerating economic growth.

For instance, our question about why firms in Brazil invest so little in R&D closely echoes the innovation paradox proposed by Cirera & Maloney (2017). Indeed, it seems paradoxical that developing countries underinvest in innovation, given that it is widely regarded as a key path to economic growth and development. The authors highlight not only the importance of innovation for productivity and growth but also several factors that reduce the returns on R&D investment in developing countries. These include a lack of complementarities—specifically, the physical and human capital needed to achieve the expected outcomes from R&D—as well as insufficient managerial capabilities.

From our perspective, however, the absence of complementarities or managerial capabilities is not a fully satisfactory explanation for the weak incentives to innovate in the Brazilian context. First, many of these complementarities that are missing in other developing countries are present in Brazil. Secondly, this analysis overlooks the role of the competitive environment and its impact on innovation incentives. As a result, policy discussions tend to focus on the supply side while neglecting the demand side.

To be fair, the authors do acknowledge the importance of competition, particularly via participation in international trade or GVCs, as a driver of learning and technological upgrading. However, this point is only briefly addressed and remains peripheral to the core of their work.

Lee et al. (2021) is another example of research addressing stalled economic growth through the lens of capability transition failure—specifically, the shift from implementation to design capability. They convincingly demonstrate the critical importance of this transition for sustaining long-term economic growth and provide compelling empirical evidence, using data from ninety-seven countries between 1996 and 2016. Countries like Korea successfully make this transition and sustained significant growth, while others, such as Thailand and Mexico, failed to advance their design capabilities and fell into the middle innovation trap, resulting in slowed economic progress.

However, the discussion of the reasons behind transition failure in Lee et al. (2021) is somewhat limited and overlooks key factors. They highlight two main explanations: first, institutional rigidity, which hampers the adaptation of the national innovation system toward concept design; and second, path dependency, which keeps countries locked into a trajectory centered on implementation capability. Yes, a crucial element—the competition regime, which strongly shapes firms’ incentives to climb the capability ladder—is underrepresented. To deepen our understanding of why firms in Brazilian firms fail to develop more advanced capabilities, we need an analysis that moves beyond merely identifying capability transition failure as the source of economic stagnation.

4. The Underestimated Effects of Important Changes in the World

In the previous section, we summarized various perspectives and explanations about why Brazil’s economic growth has remained below the pace needed to climb the per-capita income ladder. Each of these explanations contains elements of truth. Macroeconomic stability, appropriate state intervention and public spending, accumulated human capital, and functional institutions are all examples of structural and domestic factors that would undoubtedly help boost Brazil’s economy. However, none of these in isolation sufficiently explain the sudden change that occurred in the 1980s. Similarly, while discussions about catching up and transitioning to a knowledge economy shed light on Brazil’s challenges, they fall short of fully explaining why the country has struggled to overcome these hurdles.

In this section, we introduce some external factors often overlooked in these analyses. Changes in the global economy—especially since the 1980s and 1990s—have significantly influenced Brazil’s economic conditions. We will focus on three specific external factors: globalization, the emergence of GVCs, and the rise of knowledge-intensive entrepreneurship (KIE).

4.1. Globalization and the Relevance of Domestic Markets

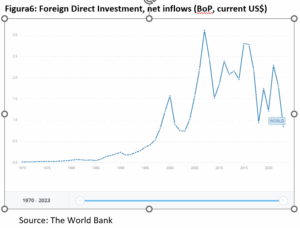

Globalization since the 1980s has unfolded across multiple dimensions. Among them, we can highlight the globalization of finance, production, and technology (Canuto, 2021). Our focus here is on the globalization of firms and industries, with Foreign Direct Investment (FDI) serving as a key indicator of this process.

As Figure 6 illustrates, FDI rose from a modest US$10 billion in 1970 to over US$2.3 trillion in 2021, peaking at US$3 trillion before the global crisis in 2007. This surge has been particularly notable since the 1980s, with a marked acceleration throughout the 1990s.

For three or four decades after the Second World War, foreign trade was the primary driver of globalization. A major shift occurred from the 1980s onward, when globalization became closely tied to FDI. This period is often referred to as “Globalization 2.0” or “hyper-globalization” (Canuto, 2021).

The evolving landscape of global competition can be summarized by the transformation of multinational companies from multidomestic to truly global firms (Porter, 1986). Competition no longer occurs on a country-by-country basis but has become genuinely global. Firms have moved away from managing international operations as a portfolio of subsidiaries acting like domestic firms (multidomestic) and instead now integrate these activities across borders.

One consequence of this transformation is the functional integration of geographically dispersed activities within multinational companies (Sachwald, 1994), which has significant implications for the economic relevance of domestic markets in countries where these companies operate.

We can illustrate this point with the case of the automobile industry, a key sector in Brazilian manufacturing, and the intense globalization process it has undergone since the 1990s. The industry has experienced significant changes—such as the rise of global cars, reduction in the number of platforms, global sourcing, and a hierarchical organization of suppliers—which have had a profound impact on the Brazilian auto parts industry (Costa & Queiroz, 2000).

In addition to increasing demands for product quality, technology, and complexity, Brazilian auto parts companies needed to become global suppliers. Firms such as Metal Leve, Cofap, and Freios Varga, although large and competitive by Brazil’s standards, became miniscule compared to the increasingly internationalized industrial complex and were eventually acquired by foreign companies. The global nature of competition, cross-country interlinkages, and technological change have all deepened in the recent past (Canuto & Martins, 2024).

In short, globalization has made growth strategies based on the size of domestic markets highly compromised. This scenario echoes the warning issued by Fajnzylber (1983) when comparing the industrialization experiences of Latin American countries with those of their Asian counterparts. While Latin American countries followed a strategy of indiscriminate, small-scale reproduction of industries already existent in advanced countries, typical of import-substitution processes, Asian countries adopted a strategy led by domestic players focused on the global market. This approach has proven much more effective. Not by chance, Brazil and South Korea stand as “two tales of a MIT”—with Brazil trapped while South Korea continues its climb up the income ladder to reach advanced-economy status (Canuto, 2020).

4.2. GVCs

GVCs, where intermediate goods and services are traded through fragmented and internationally dispersed production processes, are another key expression of globalization.

These chains, closely linked to FDI, are largely controlled by Transnational Companies (TNCs). According to UNCTAD (2013), 80% of global trade is conducted through GVCs coordinated by these companies.

The contribution of GVCs to economic growth is significant (Canuto, 2021). In developing countries, the value added by trade accounts for nearly 30% of GDP on average, compared to 18% in developed countries. GVCs have a direct economic impact on value added, employment and income. There is a strong correlation between participation in GVCs and GDP per capita growth rates. The 30 developing economies with the highest growth in GVC participation from 1990 to 2010 experienced a median GDP per capita growth rate of 3.3%, compared to just 0.7% for the bottom 30.

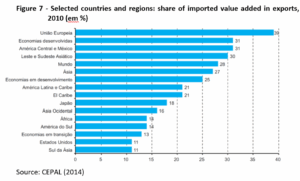

For very large, developed economies—such as Japan and the United States—the benefits of GVC participation are relatively small. However, this is not the case for Brazil. The country’s low participation in GVCs, with notable exceptions like the aeronautics industry, limits its economic growth potential.

This issue extends beyond Brazil to Latin America as a whole, with Mexico and Central America being more integrated into GVCs through the “maquiladoras” (CEPAL, 2014). Figure 7, which shows imported inputs in exports as an indicator of GVC participation, places South America at the bottom of the world’s regions in terms of integration into these chains. In terms of foreign trade, Brazil has one of the most closed economies in the world (Canuto et al., 2015).

In recent years, the geopolitical dispute between the U.S. and China has intensified, with likely consequences for the architecture of global trade. One potential effect is industrial relocation—through nearshoring and reshoring—driven by the need to ensure greater security of supply chains. Although these trends are still in their early stages (Alfaro & Chor, 2023; Canuto et al., 2023), they may expand in the near future and present a new opportunity for Brazil to deepen its integration into GVCs.

4.3. KIE

Since its emergence two decades ago, the concept of open innovation has attracted growing interest in both academia and business. The central idea of the model proposed by Chesbrough (2003) is that successful companies commercialize not only their own innovations but also those originating from other firms.

The boundaries between companies and their surrounding environments have become more porous, allowing knowledge to flow into the firm from outside. The traditional model of self-sufficiency—where a company creates, develops and commercializes its own ideas—dominated industrial R&D for much of the 20th century. Recently, this model has given way to one where so-called external R&D, conducted beyond company walls, is gaining prominence.

This shift in the internal/external R&D balance, along with the growing emphasis on networked innovation—where multiple actors collaborate and coordination is key to success—has opened significant space for startups. These newly established innovative firms often generate the ideas later commercialized by large industrial corporations.

Startups can make a decisive contribution to the innovation process. Chesbrough & Rosenbloom (2002) show that these small companies have greater flexibility in adjusting their business model—that is, in effectively mediating between the technical and economic domains. This is largely because the internal filters typical of established, successful companies often hinder the adoption of business models that deviate significantly from their existing frameworks.

In recent years, the number of studies on KIE and innovation ecosystems has increased, including some of our own contributions (Alves et al., 2019; Fischer et al., 2018; Fischer et al., 2019). This growing body of literature, which explores the phenomenon from multiple perspectives, reflects a widespread recognition of the increasingly important role startups play in the innovation process.

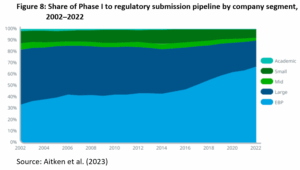

The significance of startups in generated new technologies varies across sectors. The pharmaceutical industry is a notable example, where emerging companies have become integral to the sector’s R&D and innovation ecosystem. The relative importance of in-house R&D in large companies within large pharmaceutical companies—known as the Big Pharma—has declined in favor of collaborative R&D with external partners, particularly innovative startups.

The participation of so-called Emerging Biopharma Companies (EBPs) in the pharmaceutical pipeline is expanding, as illustrated in Figure 8. While large firms continue to lead the sector, it is increasingly evident that the space for new players, such as startups and EBPs, is likely to grow in the future.

Other examples beyond the pharmaceutical industry can be explored to deepen the understanding of the evolving role of startups in the innovation process. This may represent a significant opportunity for Brazil, as its postgraduate and research system—based in both public and private universities and institutes—has the potential to provide a major boost to KIE.

To conclude this section, it is worth noting that major changes in the global economy over the past several decades have significantly affected Brazilian economic conditions. Globalization, the emergence of GVCs, and the rise of KIE have reduced the centrality of the domestic market as a key pillar of growth and innovation. These shifts have also seriously undermined the strategy of import substitution as a viable path for industrialization.

5. An Additional Explanation for Innovation and Economic Stagnation

We can now begin to draw some conclusions regarding two related questions addressed in this paper: Why do Brazilian firms engage so weakly in innovation activities? And why does Brazil’s potential economic growth remain so low?

Representatives of industry associations in Brazil, such as the CNI (Confederação Nacional da Indústria), frequently align with developmentalist perspectives in attributing Brazil’s premature de-industrialization and sluggish economic growth to neoliberalism. A telling example is a recent statement by Rafael Lucchesi, a CNI director, during a panel at the Fifth National Conference on Science, Technology and Innovation held in Brasília:

“If we take the last 80 years of Brazil and divide them into two 40-year blocks, in the first, Brazil industrialized and was the fastest-growing country in the world. It went from a rural and agrarian society to an industrial and urban society. In fact, let’s be a little honest, everything we know about Brazil, the cities, the wealth, the economic development, the middle class that we have and built, was created by this industrialization process. And in the last 40 years, when we decided to believe a lie that was repeated many times, that everything was wrong, that our model was wrong, we became the country that lost the most productive complexity. We are the biggest loser…

In a major strategic error, we managed to regress, become poorer, and lose prominence. That’s all we achieved by adopting this neoliberal package, it’s important to say this… because we are ideologically biased, because we followed John Williamson’s advice, which is commonly referred to as the Washington Consensus, and we regressed and fell behind. We missed the train of history. We have to make up for lost time. And we have to build an industrial policy agenda, very well coordinated by this government, which is creating a state plan.”

In fact, the complaint against those who criticize the import-substitution industrialization model as a whole is justified. It functioned effectively for nearly 50 years, beginning in the 1930s. The issue, however, is that due to rising public-sector indebtedness, the model became exhausted as a source of dynamism—even before the process of shifting labor from low-productivity to higher-productivity activities had been completed (Canuto, 2019; 2023).

While export-oriented industrialization flourished during the era of hyper-globalization, Brazil remained heavily reliant on its domestic market. Despite its considerable size, this market gradually lost relative importance. The glaring exceptions have been Brazil’s modern, technology-intensive agriculture and aircraft industries, both of which are strongly export-oriented.

Perhaps the most detrimental legacy of the import-substitution strategy has been the inward-looking orientation of Brazil’s industrial sector. For decades, focusing on the domestic market was sufficient to secure sizable profits—at least until the end of the 2000s (Canuto et al., 2013). Furthermore, competition from imports was limited, as tariffs and a range of other protective instruments shielded local producers (Canuto et al., 2015).

Unfortunately for Brazil, the lessons from Fajnzylber (1983) were never internalized. Not only did he highlight the superior export-oriented strategies of Asian countries, but he also drew a crucial distinction between what he termed frivolous protectionism—as practiced in Latin America—and learning-oriented protectionism—as seen in Asia. His assessment has proven accurate over the past four decades (Canuto, 2021).

This raises a fundamental question: Why would firms take risks and invest in R&D under conditions of frivolous protectionism and limited competition? Why would they engage in innovation activities if survival and profitability do not depend on it?

Ten years ago, Pedro Passos—one of the founders of Natura, a successful cosmetics company, and at the time president of IEDI (Instituto de Estudos para o Desenvolvimento Industrial), an industry think tank—wrote:

“Competing in foreign markets and importing goods and services help expand production scales, reduce costs, allow access to state-of-the-art inputs and capital goods and, perhaps most importantly, increase competition, which in turn stimulates investment in innovation and the search for greater quality and productivity”.

This serves as a reminder that Brazil does have a small but influential group of industry representatives advocating for change in the current economic model. In addition to the agriculture sector—which, by targeting global markets, has managed to scale up, adopt new technologies, and become internationally competitive—a select group of industrial companies also stands out. These firms do not suffer from inward-looking bias and have established a significant presence in foreign markets. Natura is one such example, but we could also cite Embraer, Weg, Suzano, and a few others that have learned not to depend solely on the domestic market.

What does the experience of these exceptions in the industrial sector teach us? Primarily, that this small group of companies shows a strong commitment to R&D and innovation, even if their levels of R&D expenditure still fall short of those observed among global market leaders. The picture portrayed in the second section regarding Brazil’s innovation failure would look quite different if such cases were the rule rather than the exception.

Moreover, the inward-looking bias acts as a barrier to entry into GVCs and helps explain Brazil’s limited participation in them, as discussed in section four. Countries that adopted industrialization strategies less dependent on domestic markets found more effective paths into GVCs.

The exceptional case of Embraer illustrates how this works. A key strategy employed by the company is engaging a large number of partners in the development and manufacturing of its regional and military aircraft. By securing a relevant position in the value chain—particularly in the design and final assembly of aircraft—Embraer developed the capability to identify and effectively coordinate numerous external partners and suppliers of parts and components, borrowing externally generated knowledge and assimilating it internally.

To reach a leadership position in the regional jet market, expand its presence in executive aviation, and achieve successful forays into military aviation, the company accumulated technological and managerial capabilities essential to its global competitiveness. None of this would have been possible without its early orientation toward the international aviation market.

Similar traits can also be observed in Petrobras—the Brazilian mixed-capital oil company—particularly during periods when it was not constrained by politically driven “buy local” mandates or investment decisions (Canuto & Nankani, 2020).

In conclusion, the relationships between R&D expenditure and innovation, between technological change and productivity growth, and between increased productivity and economic growth are well established. Consequently, the low levels of business R&D investment, slow productivity growth, and weak economic performance seen in Brazil are interconnected phenomena. To break this vicious circle and escape the trap of growing too slowly to move up the per-capita income ladder, the country must overcome its inward-looking bias. It is not sufficient for companies to simply increase R&D expenditure; it is equally necessary to strengthen their learning and innovation capabilities.

6. Setting the Agenda in Accordance with a Changing World

To overcome the barriers to innovation and economic growth in Brazil, it is essential to consider not only domestic but also external factors. Moreover, promoting innovation requires addressing both the supply and demand side. On the supply side, this includes ensuring the availability of physical and human capital, building institutions that facilitate innovation, and implementing subsidy schemes, fiscal incentives, and targeted government programs. Equally important on the demand side is to foster an economic environment—especially a competitive regime—that compels firms to innovate.

Let us begin by revisiting the three changes in the international landscape discussed in Section 4 and examining their implications for a renewed agenda to accelerate innovation.

6.1. Globalization, GVCs and KIE: what do they mean for innovation in Brazil?

The slowdown of the Brazilian economy in the 1980s had several circumstantial causes. Macroeconomic imbalances that had been building since the late 1970s began to exact their toll. In 1980, Delfim Netto, then Minister of the Economy, attempted to address these challenges by boosting economic activity—a move that led to a surge in inflation and further deterioration of the balance of payments.

This situation was exacerbated by the U.S. Federal Reserve’s sharp interest rate hikes to combat domestic inflation. Since most of Latin America’s (and South Korea’s) external debt was contracted at floating interest rates, the Fed’s policy shift quickly undermined debt solvency across the region.

Mexico’s default on its external debt in August 1982 triggered a global crisis that affected all highly indebted countries, including Brazil. It took until 1994 for Brazil to control inflation through the Plano Real and until the 2000s to reach a stable balance of payments position.

More structurally, as discussed earlier, globalization in the 1980s fundamentally altered the environment in which the Brazilian economy operated, drastically reducing the relevance of the domestic market. A potential response to this new context could have been to replace frivolous protectionism with a greater openness to trade. Indeed, President Collor de Mello—Brazil’s first democratically elected leader after the military regime—attempted to move in that direction. In a widely remembered speech, he likened domestically produced cars to “wagons,” urging the automobile industry to become more competitive and align with international standards.

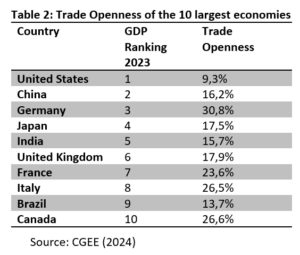

The limited trade openness seen in the following years did not change the fact that Brazil remained one of the most closed economies among the world’s ten largest—second only to the U.S., whose economy is many times larger than that of Brazil (Canuto et al., 2015), as shown in the Table below.

In recent years, new developments have begun to challenge globalization. The geopolitical dispute between the U.S. and China is the most prominent of these, and the recent turbulence caused by the current U.S. administration is further evidence of this shift. In addition, the Covid-19 pandemic raised concerns about national security risks stemming from disruptions in global supply chains. A legitimate question, therefore, is whether it still makes sense to promote the internationalization of the economy in what some call a de-globalization scenario (Canuto, 2023b). Are the lessons from Fajnzylber (1983) still valid?

Our answer to this question is affirmative. Overcoming the inward-looking bias and adopting an “Asian” approach to development strategyparticularly for the manufacturing industryremains relevant. However, this does not imply replicating the reforms that should have been implemented 40 years ago. A necessary adjustment is to take into account the concerns that are currently driving reshoring, nearshoring, and powershoring.

In fact, the ongoing changes in the global economy can create new opportunities for countries like Brazil. Advocating for powershoring, Arbache & La Rovere (2023) discuss the potential of green hydrogen production in Latin America and the Caribbean, particularly in Brazil. However, they emphasize the importance of developing the entire value chain associated with green hydrogen, including its application to the decarbonization of other segments of the domestic industry. The benefits, as they see them, are clear:

“The promotion of productive transformation provided by powershoring can contribute to the formation and consolidation of regional value chains, benefiting small and medium-sized companies, having substantial impacts on productivity and competitiveness, generating taxes, exports and foreign exchange, technology and innovation in Latin America and Caribbean”.

In this reconfiguration of the GVCs, influenced both by geopolitical changes and the imperative of decarbonization, a window of opportunity may be opening for Brazil to pursue deeper integration into the global economy. This is no simple task. To fully seize this opportunity, the country must address a number of challengesincluding improving the business environment, implementing regulatory reforms, and investing in infrastructure, as previously discussed. Nonetheless, as the example of powershoring shows, participation in newly emerging value chains can yield significant rewards.

The rise of KIE offers another potential pillar for a renewed development strategy, one that is directly linked to innovation. While overcoming the inward-looking bias and seeking greater participation in GVCs primarily affects the demand for innovation, promoting KIE impacts the supply side. Success in this area depends largely on domestic capabilities and conditions.

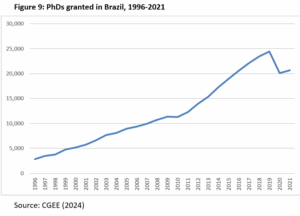

The opportunity lies in the fact that, over the past four decades, Brazil has built a substantial system of postgraduate education and scientific research. As illustrated in Figure 9, the number of doctoral degrees granted in Brazil increased steadily from 1996 until the pandemic, reaching 24,430 in 2019. Today, Brazil graduates more than 20,000 PhDs per year, with 56% of them concentrated in five key fields: Exact and Earth Sciences, Engineering, Agricultural Sciences, Biological Sciences and Health Sciences.

This accumulation of human capital has been accompanied by the gradual development of a national research system composed of universities, public and private research institutes, and a select group of companies. Most importantly, this system has become the foundation for several entrepreneurship ecosystems that have emerged across Brazil in recent years.

In the state of São Paulo, for instance, this development has been supported by FAPESP through research and innovation innovations such as the PIPE (Innovation Research in Small Business) Program. This has led to the creation of a number of successful startups, suggesting that Brazil is well positioned to benefit from the new role KIE is playing around the globe.

6.2. Some Policy Implications

As a corollary of the discussion above, several policy measures should be considered to help Brazil overcome its inward-looking bias:

1. Fight frivolous protectionism. For instance:

a. Progressive reduction of import tariffs in line with the recommendation by Bacha (2013) to trade tariffs for more competitive exchange rates.

b. Condition protectionist measures on the development of technological capabilities by the beneficiaries, with clearly defined goals for achieving international competitiveness within a certain timeframe. These measures must be temporary and subject to regular evaluation.

c. The same principle should apply to local content requirements. It would be inappropriate, for example, to attempt to revive the Brazilian naval industry without identifying segments with real potential for international competitiveness and without establishing a clear timetable for the withdrawal of incentives (Alves et al., 2021).

2. Foster internationalization. For instance:

a. Subsidy schemes and fiscal incentives should be tied to plans for increasing exports and/or promoting outward FDI. The focus on global markets must be sustained and long-term.

b. All forms of international partnerships should be incentivizedfrom joint ventures between Brazilian and foreign companies to the attraction of international talent, such as scientists, engineers and skilled workers.

3. Focus on the entire value chain in selected industries where Brazil has already developed, or shows potential to develop, capabilities. For instance:

a. Brazil’s global competitiveness in agricultural creates favorable conditions to integrate into GVCs that supply manufactured goods and services to the sector.

b. Similar opportunities exist in industries where Brazil has already made significant advances, such as aeronautics, pulp and paper, pharmaceuticals, and cosmetics.

c. The climate change agenda also presents strategic opportunities for Brazil, given its relatively clean energy matrixprovided it is paired with a “no deforestation” policy (Canuto, 2023b).

7. Conclusion

As discussed above, several innovation-focused policies have failed to deliver the expected results. An instructive comparison can be made between the evolution of industrial and technological policy and that of macroeconomic policy. After five unsuccessful attempts to control inflation during the late 1980s and early 1990s, the Plano Real finally succeeded in 1994. This success was the result of a learning process that led to improved diagnostics of the particular conditions that were producing inflation in Brazil and consequently a better understanding of more effective measures to deal with it. Three decades later, however, no equivalent learning process has emerged to address Brazil’s premature de-industrialization, failed innovation strategies, and stagnant productivity and economic growth.

Evidently, the challenges are not directly comparable. Reaching political consensus to fight inflation proved to be much easier than forging agreement on a path forward for industrial policy. Aligning divergent interests and visions across sectors such as manufacturing and agriculture, and among the various actors in the innovation system, is more complex.

Nevertheless, the economic and political debate in Brazil continues to underestimate the extent to which global dynamics have changeddynamics that no longer allow the country to perform as it once did. Advancing this debate requires acknowledging that globalization strongly penalizes growth strategies overly reliant on domestic markets. While recent shifts in globalization introduce new challenges, they do not herald a return to the inward-looking policies of the past.

If Brazil is to effectively promote innovation and accelerate economic growth, it must create a more competitive economic environment. This requires dismantling trade barriers and pursuing the internationalization of its firms. Frivolous protectionism merely sustains rent-seeking behavior by inefficient firms. Overcoming the inward-looking bias of Brazilian industry is a crucial step toward raising business R&D investment and promoting innovation.

Pushing forward an agenda to increase competition in the Brazilian economy is no easy task. Yet, it must be viewed as part of a broader and more urgent mission: breaking free from the MIT into which the country has fallen.

To be clear, fostering competition alone is not sufficient to transform Brazil into an innovation-driven economy. As discussed throughout this work, several complementary conditions must also be in place. Assessing the role of each of these conditions is, therefore, a necessary complement to our discussion. Still, our goal has been to shed light on why the strategies that worked four decades ago are no longer effective today, and why industrial and innovation policies that fail to account for these structural shifts are unlikely to succeed.

References

Abramovitz, M. (1956) “Resource and output trends in the United States since 1870”, reimpresso em Rosenberg, N. (org.), Economia del cambio tecnológico, Fondo de Cultura Económica, México, 1979.

Acemoglu, Daron & Robinson, James A. – Why Nations Fail: the origins of power, prosperity, and poverty, Profile Books, 2012.

Agénor, Pierre-Richard & Hinh T. Dinh. “From Imitation to Innovation: Public Policy forIndustrial Transformation.” Economic Premise No. 115, World Bank, Washington DC, 2013.

Agénor, Pierre-Richard &Canuto, O. – Middle-income growth traps, Research in Economics, Volume 69, issue 4, December, p. 641–660, 2015.

Agénor, Pierre-Richard &Canuto, O. – Access to finance, product innovation and middle-income traps, Research in Economics, Volume 71, Issue 2, June, p. 337-355, 2017.

Aitken, M. et al. Global Trends in R&D 2023 – Activity, Productivity, and Enablers. IQVIA Institute for Human Data Science, February 2023.

Aiyar, S.; Duval, R., Puy, D.; Wu, Y. and Zhang, L. – Growth Slowdowns and the Middle-Income Trap, IMF Working Paper. No. 13/71. Washington, DC, 2013.

Alfaro, Laura & Chor, Davin – Global Supply Chains: The Looming “Great Reallocation.” NBER Working Paper No. 31661, September 2023.

Alves, A. C.; Vonortas, N. S.; Zawislak P. A – “Macro and micro foundations for technology upgrading and innovation: The case of shipbuilding and offshore industry in Brazil”, in Lee, J.-D-., Lee, K., Meissner, D., Radosevic, S., Vonortas N. S. (eds) The Challenges of Technology and Economic Catch-up in Emerging Economies, Oxford University Press, 2021.

Alves, A. C.; Fischer, B.; Schaeffer, P. R.; Queiroz, S. – Determinants of student entrepreneurship, Innovation & Management Review, v. 16, 2019.

Arbache, J. & La Rovere, E. L. – Transição Energética e Powershoring na América Latina e Caribe: Oportunidades, Desafios e Políticas Públicas, Banco de Desenvolvimento da América Latina e Caribe, Rio de Janeiro, December/2023 (updated in March/2024).

Arcangeli, F. and Canuto, O. – Foundations of New Growth Models: Technology and the Schumpeterian Heritage, International Workshop on Technological Learning, Innovation and Industrial Policy: National and International Experiences, UAM-X, Ciudad de Mexico, september 1996.

Bacha, E. – Integrar para crescer. O Brasil na economia mundial, Estudos e Pesquisas nº 511, Fórum Nacional, Rio de Janeiro, 18-19 de setembro de 2013.

Barbosa Filho, Fernando de Holanda & Pessôa, Samuel – Educação e Desenvolvimento no Brasil, in Veloso, Fernando et al. (orgs.) – Desenvolvimento Econômico: uma perspectiva brasileira, Elsevier-Campus, 2013.

Bresser-Pereira, Luiz Carlos et al. – Macroeconomia Desenvolvimentista: teoria e política do novo desenvolvimentismo, Elsevier, 2016.

Canuto, O. – Competition and endogenous technological change: an evolutionary model, Revista Brasileira de Economia, volume 49 (I), Jan.-Mar. 1995, p. 21-33.

Canuto, O., Dutz, M. and Reis, J.G. – “Technological Learning and Innovation: Climbing a Tall Ladder”, in Canuto, O. and Giugale, M (eds.), The Day after Tomorrow: A Handbook on the Future of Economic Policy in the Developing World, World Bank. Washington, DC., 2010.

Canuto, O.; Cavallari, M.; and Reis, J.G. – Brazilian Exports: Climbing Down a Competitiveness Clif, Policy Research Working Paper 6302, World Bank, January 2013.

Canuto, O.; Fleischhaker, C.; and Schellenkens, P. – The Curious Case of Brazil’s Closedness to Trade, Policy Research Working Paper 7228, World Bank, April 2015.

Canuto, O. and Cavallari, M. – Long-term finance and BNDES tapering in Brazil, OCP Policy Center, Policy Brief PB-17/20, June 2017.

Canuto, O. and Ribeiro dos Santos, T. – It’s evolution, baby – how institutions can improve without critical junctures, Policy Center for the New South, November, PB 18-39, 2018.

Canuto, O. – Traps on the road to high income, Policy Center for the New South, Policy Brief PB-19/14, April 2019.

Canuto, O. – Brazil, South Korea: Two Tales of Climbing an Income Ladder, Policy Center for the New South, Policy Brief PB-20/70, September 2020.

Canuto, O.; Cavallari, M. and Ribeiro dos Santos, T. – “Middle-Income Countries and Multilateral Development Banks: Traps on the Way to Graduation”, in Alonso, J.A. and Ocampo, J.A. (eds.), Trapped in the Middle? Developmental Challenges for Middle-Income Countries, Oxford University Press, 2020.

Canuto, O. and Nakane, M.I. – Brazil at a Post-Pandemic Macroeconomic Crossroads, Policy Center for the New South, Policy Brief PB 20 – 87, December 2020.

Canuto, O. – Climbing a high ladder: development in the global economy, Policy Center for the New South, 2021.

Canuto, O. – Jumpstarting the Brazilian Economy, Milken Institute Review, October, 2023a.

Canuto, O. – The Amazon Needs the Rule of Law, Not the Rule of Chainsaw, Policy Center for the New South, January 2023b.

Canuto, O.; Arbouch, M.; Zhang, P.; and Ait Ali, A. – GVCs, Resilience, and Efficiency Considerations: Improving Trade and Industrial Policy Design and Coordination, T20 India, June 2023.

Canuto, O.; Dihn, H.; and El Aynaoui, K. – The Middle-Income Trap and Resource-Based Growth: the Case of Brazil, Policy Center for the New South, Research Paper RP – 05/24, March 2024.

Canuto, O.; and Martins, J.A. – The Automotive Transition on the Road to Decarbonization, Capital Finance International, Autumn 2024.

CEPAL – Integração regional: por uma estratégia de cadeias de valor inclusivas, 2014.

CGEE – Centro de Gestão e Estudos Estratégicos. Brasil: Mestres e Doutores 2024. Brasília, DF: CGEE, 2024. Available in: https://mestresdoutores2024.cgee.org.br

Chesbrough, H. W. – Open Innovation: The New Imperative for Creating and Profiting from Technology, Harvard Business School Press, Boston, 2003.

Chesbrough & Rosenbloom, The role of the business model in capturing value from innovation: evidence from Xerox Corporation’s technology spin-off companies, Industrial and Corporate Change, vol.11, nº 3, 2002.

Cirera, X. & Maloney, W. F. – The Innovation Paradox: Developing-Country Capabilities and the Unrealized Promise of Technological Catch-Up, World Bank Group, 2017.

Coase, R. H. (1937), La empresa, el mercado y laley, Alianza Editorial, Espanha, 1994.

Costa, I. & Queiroz, S. “Autopeças no Brasil: mudanças e competitividade na década de noventa”, Revista de Administração da USP, V.35, N.3. – julho/setembro 2000.

Fajnzylber, F. – La Industrialisación Trunca de América Latina, Centro de Economia Transnacional, Editora Nueva Imagen, México, 1983.

Fischer, B.; Schaeffer, P. R.; Queiroz, S.; Vonortas, N. – On the location of knowledge-intensive entrepreneurship in developing countries: lessons from São Paulo, Brazil, Entrepreneurship and Regional Development, v. 30, p. 1-27, 2018.

Fischer, B.; Schaeffer, P. R.; Vonortas, N.; Queiroz, S. – Quality comes first: university-industry collaboration as a source of academic entrepreneurship in a developing country, The Journal of Technology Transfer, v. 43, p. 263-284, 2017.

Fogel, R. & Engerman, S. – Time on the cross, Little, Brown & Co., Boston, 1974.

Gill, Indermit S. & Kharas, Homi et al. “An East Asian Renaissance: Ideas for Economic Growth.” World Bank, Washington, DC, 2007.

Gill, Indermit S. & Kharas, Homi – “The Middle-Income Trap Turns Ten”, Policy Research Working Paper 7403, World Bank, Washington DC, 2015.

Gonçalves, Carlos Eduardo Soares – Desenvolvimento econômico: uma breve incursão teórica, inVeloso, Fernando et al. – Desenvolvimento Econômico: uma perspectiva brasileira, Elsevier-Campus, 2013.

Group of Thirty – Why does Latin America underperform?, Washington, 2023.

Han, X. and Wei, S-J. – Re-examining the middle-income trap hypothesis (MITH): What to reject and what to revive?, Journal of International Money and Finance, Volume 73, Part A, May, p. 41-61, 2017.

IEDI (2010) Incentivos para a inovação: o que falta ao Brasil, Estudos “Desafios da Inovação”, fev/2010.

Katz, J. (ed.) – Technology Generation in Latin American Manufacturing Industries, MacMillan, Londres, 1987.

Lall, S., “Technological Learning in the Third World: Some Implications of Technology Exports”, in Stewart & James – The Economics of New Technology in Developing Countries, Frances Pinter, Londres, 1982.

Lee,Jeong-Dong et al. – Middle Innovation Trap:Capability Transition Failure and Stalled Economic Growth, in Lee,Jeong-Dong et al. (eds.) The Challenges of Technology and Economic Catch-up in Emerging Economies,Oxford University Press, Oxford, 2021.

Lee, Keun. Schumpeterian Analysis of Economic Catch-up: Knowledge, Path-Creation, and The Middle-Income Trap. Cambridge, Cambridge University Press, 2013.

Lee, J.-D.; Baek, C.; Yeon, J.-I. “Middle innovation trap: Capability transition failure and stalled economic growth”, in Lee, J.-D-., Lee, K., Meissner, D., Radosevic, S., Vonortas N. S. (eds) The Challenges of Technology and Economic Catch-up in Emerging Economies, Oxford University Press, 2021.

MCTIC – Indicadores Nacionais de CTI 2022.

Mendes, Marcos (org.) – Para não esquecer: políticas públicas que empobrecem o Brasil, Insper, Rio de Janeiro, 2022.

Monasterio, L.&Ehrl, P. – “Colônias de povoamentevs colônias de exploração: De Heeren a Acemoglu”, Textos para discussão 2119, IPEA, Brasília, agosto de 2015.

Nassif, André – Desenvolvimento e Estagnação: o Debate Entre Desenvolvimentistas e Liberais Neoclássicos, Contracorrente, 2023.

North, D. – The Rise of the Western World: A New Economic History, Cambridge University Press, Cambridge, 1973.

North, D. – Institutions, Institutional Change and Economic Performance, Cambridge University Press, Cambridge, 1990.

Pacheco, Carlos Américo & De Negri, Fernanda – Qual o rumo? Estadão, 10/12/2022, https://www.estadao.com.br/opiniao/espaco-aberto/qual-o-rumo/

Porter, M. E. – “Competition in Global Industries: A Conceptual Framework”, in Porter, M. E. Competition in global industries, Harvard Business School Press, Boston, 1986.

Romer, P.M. – Endogenous technical change. J. Political Economy 98, S71–S102, 1990.

Sachwald, F. – “Mondialisation et systèmesnationaux”, in Sachwald, F. Les défis de la mondialisation – Innovation et concurrence, Masson, Paris, 1994.

Shelton, Jon – The Education Myth: how human capital trumped social democracy, Cornell University Press, 2023.

Solow, R. M. (1957), “TechnicalChangeandtheAggregateProductionFunction”, reimpresso em Rosenberg, N. (org.), Economia del cambio tecnológico, Fondo de Cultura Económica, México, 1979.

UNCTAD – World Investment Report 2013 – Global Value Chains: Investment and Trade for Development , 2013.

Veloso, Fernando et al. – Índice de Capital Humano (ICH) Anual, FGV-IBRE, Junho de 2013.

Williamson, O. – Lasinstituciones económicas del capitalismo, Fondo de Cultura Económica, México, 1987.

This Post Has One Comment

Future study could also addresses if there are correlations between the problem of risk aversion to investing in projects with possible long-term returns, as is the case of R&D investiments, when, for example, the history of monetary and exchange rate policies shows high interest rates and volatile exchange rates, as is the case in Brazil.