Picture a Latin American country sitting on US$350 billion of international reserves, while running current account deficit, fiscal deficit and paying an interest bill on public debt that hovers above 5% of GDP every year. Given the enormous opportunity costs of hoarding such chest of gold, how could that money ever be used outside a crisis situation, without unleashing the very currency appreciation that it disguisedly tried to curtail? Brazil could well be in that position by the end of 2010 if the same rate of reserve accumulation observed in 2007 prevails in the next 18 months (and, in fact, the current pace is not too far from it).

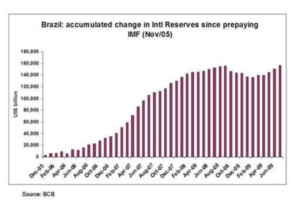

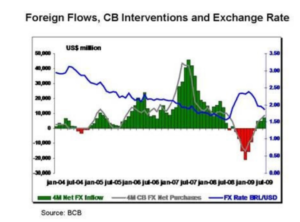

Since 2002, strong capital inflows have sustained a process of exchange rate appreciation in Brazil, briefly interrupted in the last quarter of 2008 by the financial crisis. To be fair, several other emerging market currencies behaved likewise. For most of this period the sum of the current account and direct investment has posted positive figures, accumulating US$ 90 billion since 2003. Net portfolio inflows amounted to US$ 80 billion in total from 1Q03 through 3Q08 (having spiked to US$ 48 billion in 2007) and net loan flows totaled a positive US$75 billion in the same period (excluding IMF flows). In this environment of abundant liquidity, Brazil prepaid the IMF in November 2005. Since then, the CB and the Treasury interventions in the market have escalated amassing net purchases of US$ 169 billion by September 2008, with international reserves (IR) piling up to above US$ 200 billion.

Reserve accumulation, even within a floating exchange rate regime, has been widely seen as a self-insurance device against volatility and sudden stops, given that this insurance could not be properly provided multilaterally by the existing channels. The use of high levels of international reserves as an insurance mechanism has eloquently proven its effectiveness in the recent episode (2008-9). As the crisis erupted, while the floating exchange rate absorbed the shock, the reserves arsenal provided the needed liquidity in foreign currency; at the same time the Brazilian net negative external debt reversed the impact exchange rate devaluation typically had on fiscal accounts in previous crises. Given the excess of reserves over government foreign currency liabilities, as well as the dollar-long position of the public sector in domestic derivatives markets, the devaluation led to a reduction of the public sector net debt (PSND), contributing with 330 bps to the 6 percentage points plunge of the PSND/GDP ratio to 36% in 2008. The ensuing perception of a sound fiscal stance permitted the adoption of a countercyclical stance, which has been critical to avoid a deeper recession in the country. This year through July, the Central Bank reduced the basic interest rate in 500bps to a record low of 8.75%, in contrast to previous crisis, when interest rates were bumped up to avoid the free fall of the currency and its effects on consumer prices. Likewise a relaxation of fiscal targets met with mild reaction from the market (at least, so far), given the perceived solvency of the public sector under possible stress scenarios in the medium run.

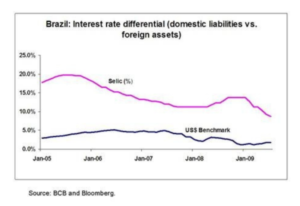

Notwithstanding the evident effectiveness of the floating exchange rate cum IR accumulation strategy in helping to absorb the external shock and sustain the confidence at levels necessary for a (relatively) quick economic recovery, some questions remain open for debate. In particular, while the benefits from the strategy seem to have been accomplished in the crisis, the costs are not negligible and the question of what should be done looking forward looks quite unresolved. The IR carrying costs have two main components: interest rate differentials and valuation effects. The first are above the line deficits resulting from the excess interest paid on domestic debt vis-à-vis the interest earned by the IR (in Brazil’s case, proxyed by the difference between the monthly Selic rate and the benchmark US rate for the relevant average maturity[2]). The second cost, which reflects the reduced R$-value of the foreign exchange assets, is mostly marked to market (below the line) and highly volatile, and would only be realized in case reserves are effectively sold.[3]

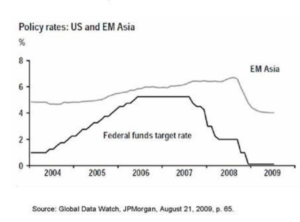

While in Asia (the leading region in IR accumulation), interest rate differentials have played a decreasing role from 2004-05, becoming more relevant after mid-07 again (see the chart from JPMorgan GDW, below), in Brazil interest differentials have been substantial all along the road.[4]

Considering that the pre-payment to the IMF signaled an assessment that IR had reached a comfortable level[5], a rough estimate of the costs incurred by the interest rate differential on the “excess” reserve accumulation since then yields a non-negligible sum of 2% of the GDP through July/09 (of this cost, more than 1% of GDP was incurred in the last 15 months).[6] At the margin, the sterilization costs stemming from the interest rate differential hovers around US$800 million per month, in 2009. One could assume that this is the premium paid for the self-insurance policy – however the idea that this cost is being inflicted to the country for the lack of an effective multilateral emergency lender providing this service as a global public good has been weakened by the strengthening of the IMF weaponry after the crisis, in particular the creation of the Flexible Credit Line (FCL).

Unfortunately, the benefits are somewhat more difficult to be assessed and quantified, and they are mostly in the form of avoided losses. We are not proceeding with this exercise here, but it should account for the precluded economic losses related to a deeper and longer crisis, which prominently include: larger direct fiscal expenditures, as interest rates on the public debt would behave procyclically in the absence of the dampening effect of the negative external PSND and the stock of debt cycle would likely present an asymmetric behavior (i.e., increasing abruptly and decreasing gradually, leaving a trail of higher debt service expenses); and the costs related to forgone growth. Previous crises have shown eloquently how these costs may be extremely significant.

Nonetheless, the fact that reserve accumulation continues to take place at a very fast pace, even after the level previous to the crisis has been restored, suggests that self-insurance might not be the driving force behind the phenomenon. Concerns about the persistent exchange rate appreciation, which have been cautiously voiced by some authorities recently, would be propelling the current push for IR accumulation, as pursuing an even higher level of insurance does not seem required at this point. The precautionary purpose was probably sufficient to explain the reserve accumulation through 2008; however, further increasing IR from that level may require other explanations.

To be fair, one cannot overlook the push factor behind the strong resumption of capital inflows in 2Q09, as the humongous liquidity injection in mature economies facing uninspiring prospects for economic recovery has apparently not found attractive outlets at home. In fact, sluggish growth for a significant period in mature economies might not be an unlikely scenario, which might signal a renewed season of excess liquidity in search or higher yields in emerging markets (see here)

In the first phase (2006-08), precautionary reserve accumulation could be questioned on the grounds of efficiency, i.e., whether the costs incurred by the strategy would be more than compensated by its harder-to-quantify benefits. Or alternatively, whether there would be a cheaper way of obtaining the same results (maybe, by keeping a lower level of reserves). In the second phase, after resuming the pre-crisis level in mid-2009, any additional accumulation of IR, considering that it remains a very costly strategy, could now be challenged on its objective (viz., avoid further appreciation of the real) and on its effectiveness (i.e., whether it can effectively withhold the pressure toward appreciation).

It is almost tautological that emerging market currencies present a longer term trend toward appreciation, as the status of emergence implies convergence towards a higher level of productivity. The issue here concerns the ability of capital flows, driven by very high coupon in the short term, to set at each moment an exchange rate that is consistent with the process of climbing up the productivity ladder in the longer term. So far, the response from the Brazilian industry seems to have been largely positive, with industrial production increasing at a consistently higher pace.

That virtuous reaction could have been fed by capital goods imports, as well as cheaper and longer term credit, facilitating technology absorption and lumpy productivity-boosting investments. In addition, financial hedges and the use of ACCs and ACEs (advances of exchange receipts for exporters) to obtain financial gains in the domestic market might have dampened some of the effects of the appreciation for the exporters[7].

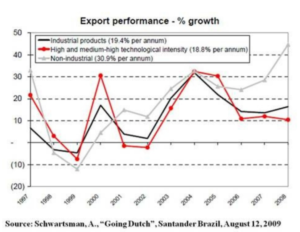

Analysts like Alexandre Schwartsman, from Santander, have resorted to recent manufacturing export performance data as a signal that concerns about the impact of exchange rate appreciation might be overstated (see following chart).

Notwithstanding that, further investigation is warranted as the fact that Brazil has lost share in the world’s industrial exports suggests a counterfactual scenario with plausibly an even higher rate of industrial expansion. Moreover, the doubts about the market being able to set the right pace for the currency appreciation have been magnified by the very factors leading to the current financial crisis in developed economies. A thorough investigation should therefore assess whether such heightened cyclical appreciation (and its ensuing correction) have hysteresis effects that are negative for the country’s competitiveness over the longer term. In other words, it is critical to know whether the cyclical fluctuations can be mainly absorbed by the financial sector, with no significant trauma and not much ado with the real sector in a longer horizon.

Assuming, for a moment, that something must be done to avoid excessive exchange rate appreciation, our attention should then shift towards assessing which instruments could be used effectively for that purpose. We are left with a three-pronged set of options: (i) putting sand in the gears to lessen the inflows of capital, either by lowering the foreign exchange coupon – reducing domestic interest rates or, for example, reinstating the IOF tax that was relaxed in 2008 – or by adopting capital controls (which in the less strict form may resemble a tax); [8] (ii) doing exactly the opposite, i.e., greasing the gears to facilitate outflows of capital or fostering Brazilian direct investment abroad; and (iii) intervening in the domestic market to dry excess foreign exchange liquidity.

Keeping draining foreign exchange into the Central Bank coffers seems to be the strategy currently, albeit not openly, adopted by the Brazilian authorities. As explained by the BCB Deputy Governor for Monetary Policy (link in Portuguese), pumping out foreign liquidity from the market tends to further encourage inflows, as expectations tilt toward appreciation (or to a reduced likelihood of depreciation) and pushes the coupon up. Capital inflows becomes endogenously determined by CB interventions, as any intervention above the level of inflow would bring inflows to the new level in t+1, without affecting the exchange rate. Would the same reasoning apply symmetrically, with less intervention lowering inflows? Apparently not, as the current strategy implicitly assumes that drying up excess liquidity would help balance the market and avoid undue volatility.

The bottom line is two-fold:

1. There is ground to doubt whether measures to withhold currency appreciation will ultimately remain effective, particularly if the current scenario of abundant international liquidity searching for yield in emerging markets assets is to remain for longer than next year.

2. If there is fear about the productive restructuring that would ensue from that exchange-rate appreciation, the best thing to do is address straightforwardly the negative factors that affect directly the competitiveness in technologically more dynamic sectors of the Brazilian economy. IR accumulation will likely cease to be a cost-effective means to postpone facing those challenges.