A recent Ipsos survey found the Brazilian population to be the most dissatisfied with infrastructure services (transportation, energy, water and telecommunications) among the 28 countries covered by the work. Not surprising if we observe the lack of infrastructure investments in Brazil since the 1980s.

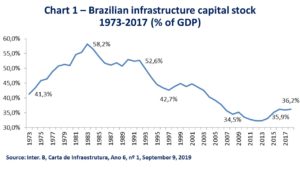

According to estimates by the economist Cláudio Frischtak, from Inter B., while Brazil’s Gross Domestic Product (GDP) doubled in real terms between 1990 and 2016, the stock of infrastructure capacity grew by just 27 %. Chart 1 displays the downfall of Brazil’s infrastructure capital stock as a proportion to GDP.

Figures from World Bank report (Raiser et al, 2017) point to infrastructure investments averaging over 5% of GDP between the 1920s and 1980s, a period in which per capita income grew at an annual rate average of 4% and urbanization reached levels of 60% in 1980. In the last two decades, however, the pace of investment has fallen to less than 2.5% of GDP, even below its maintenance needs (Chart 2, left side).

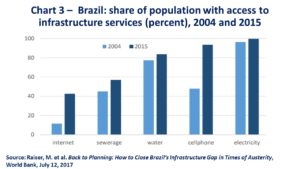

Brazil’s current inventory of physical infrastructure, relative to GDP, is smaller than most countries with comparable income levels. Although access to electricity and telecommunications has improved since the 1990s, basic sanitation and transportation networks are falling short of those of their peers – even when one considers the country’s relatively high territorial dispersion and low population density.

This lack of infrastructure investments has brought a cost in terms of poor productivity performance and slower growth rates. Substantial negative effects in terms of wasted resources – lost work time, misallocation of resources, product losses etc. – derive from poor infrastructure and poor energy supply and connectivity conditions in areas such as transportation, logistics, and information and communication technology. Lack of public investment has been hurting potential GDP growth both directly and indirectly by discouraging private investment. Low coverage in sanitation has also unfavorable implications for poor people (Chart 3).

Public infrastructure spending was squeezed as current public spending grew by 2% above GDP and primary government spending as a proportion of GDP rose from 22% in 1991 to 36% in 2014. Although public spending has stabilized since 2015 as a proportion of GDP – and since 2017 being subject to a constitutionally established absolute ceiling in real terms – the continued expansion of mandatory current spending has kept the fiscal space available for public infrastructure investments shrinking. Brazil’s “public sector obesity” has aggravated its “productivity anemia”.

The fall in public investment was not sufficiently offset by private investments in infrastructure – unlike other countries in the region, such as Chile and Colombia, as noted in the World Bank staff report. In addition, the public sector remained the source of more than 70% of this financing, depending, therefore, on prevailing fiscal conditions in the country (Chat 2 right side on transport).

The inevitable continuation of fiscal austerity in the future ahead reinforces its need to be accompanied by building new pillars of long-term financing, while reconfiguring the regulatory and operational framework to increase the participation of private investment in infrastructure. In addition to the decline in real interest rates achieved in the recent period, it will be necessary to maintain the pace of structural reforms that have gradually improved the business environment and the costs of financial intermediation. On the other hand, as much as the presence of the private sector is required to expand, investment and private management in infrastructure will remain complementary – not perfect substitutes – to the public sector.

In addition to the difficulties in terms of amounts of public infrastructure spending, in a context of downward rigidity of other expenditure items, there is the qualitative problem of its “inefficiency”. The shortfall is compounded by quality problems in such low investments, as pointed out in the World Bank report. It is important to improve the result of the part that will continue to be the responsibility of the public sector, because the whole will depend on it.

Take, for example, the deficiencies in resource allocation and operation in the transport and water and sanitation sectors, which we have already highlighted as particularly under-invested. In transport, the World Bank report estimates that the combination of a multi-modal system that favors road transport with operating inefficiencies in the federal highway system entails economic and environmental costs equivalent to 1.4% of GDP, or 2.2 times the current annual investment in the sector. In turn, operating inefficiencies in water supply have been around 0.7% of GDP, or more than three times the current annual investments in sanitation. The approval of a new regulatory framework for sanitation, underway in Congress, must bring good news for the sector.

There has been a strong incidence of project-level inefficiencies, as well as irregularities in the different stages of its cycle. There is need to reinforce upstream planning capacity, raise standards for basic engineering projects, improve risk identification and mitigation processes in the preparatory phase of projects – to avoid disruptions during implementation – strengthen economic and financial viability requirements and, not least, increase the effectiveness of bids.

But the biggest challenge may lie in some political roots of deficiencies in infrastructure investments. The way in which political coalitions have traditionally been built and campaigns funded in the country’s recent past has led to the fragmentation of budget allocations for capital investments and the frequent selection of poorly designed projects. In the same vein, the use of capital transfers and assignments to maintain fragile political coalitions within a framework of party fragmentation has undermined project planning, evaluation, selection, supervision and assurance.

Brazilian prosperity will depend on more and better investment in infrastructure, in a context of fiscal austerity. To this end, it is essential to improve the quality of public intervention and to follow the structural reform agenda.

* text prepared as a background note for Mr. Canuto’s participation at the 2020 BRAZIL BUSINESS FORUM

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.

This Post Has 3 Comments

Congratulations. Opportune and well put. After years of omission and the vicious destruction of the infrastructure regulatory legal system……..the Gross Fixed Capital will begin to increase. A most important role is expected when considering the array of projects for gas, energy, and sewage, among others in the pipeline.

Congratulations on this essay. Brasil presents glaring deficiency in its infrastructure development, maintenance and operations. For many experts, the challenge in this domain are the conflicting signals on ways and means to close the aforementioned gap. At this juncture it is worth mention concerns voiced about the quality of public investments made, as raised recently by a group of urban planners and economists, amongst which Andre Lara Resende. The fact that significant public and private investments, in roads, transport, sanitation and energy, for instance, have either been abandoned, or discontinued, after considerable pre-investments made in design, modeling and engineering, is troublesome. Yet many argue that the bias for traditional large scale public works – highways and hydroelectric plants, for instance, reduce resources to expand and improve the rail system. Including urban mass transportation, as well as improved water-sanitation plus drainage systems to face the extreme climate episodes. Still, a consensus on a national long term public investment strategy is not in place in order to improve infrastructure results.

Excellent article.

Infraestructure continues to be the pending task of so many countries, from high income to middle and lower income economies.

Could it be because of the long term nature of infrastructure investments and government officials need to decide between competing needs while looking into the next election…?

Comments are closed.