POLICY CENTER FOR THE NEW SOUTH

This article was originally published on T20 website, as our Fellow Otaviano Canuto, and research assistant in economics, Mahmoud Arbouch are part of the T20 Task Force 3 on infrastructure investment and financing.

Challenge

Africa’s Infrastructure investment needs have increased over time, reaching USD 130–170 billion a year by 2018, with a financing gap of USD 68–108 billion (AfDB 2018). Plugging Africa’s financing gap through investments in productive infrastructure would produce national and global spillover effects. Not much has been done to reduce the colossal financing gap in response to Africa’s structural lack of funding for infrastructure projects. The existing budget deficits and poor access to international capital markets call for considering alternative funding sources.

A global pact to finance infrastructure in Africa and stimulate its industrialization would be a win-win for all stakeholders. Good quality, quantity, and access to infrastructure can spur growth in the manufacturing and services sector, and reduce intraregional trade barriers. Thus, economies will be better poised to achieve the transition from low- to higher-productivity activities, effective deep economic structural changes, and joining middle- and upper middle-income countries. Furthermore, Africa’s economic prosperity will also lead to a reduction in the global poverty that sustains violence, terrorism, socio-political tensions, and uncontrolled mass migration and its contribution to high unemployment in some developed countries, notably in Europe. Policy makers in advanced and developing countries aspire to create conditions for harmonious development to generate and sustain lasting prosperity. Meanwhile, private actors everywhere are searching for profitable investment opportunities to make a rational use of their financial capabilities. Civil society organizations seek to ensure good opportunities for all citizens and create worldwide social peace. Although these players are driven by different motives, they all strive for faster growth and greater prosperity. However, because economic policy-making is still largely conceived and implemented within national borders for national constituencies, the world economy is not reaping the potential dividends of international cooperation.

Infrastructure development plays a major role in promoting growth and reducing poverty. In Africa, however, underdeveloped infrastructure continues to be a binding constraint to sustainable development. Developing Africa’s infrastructure—transport, energy, water, and e-connectivity—will be critical for countries to ensure sustainable economic development. Africa’s infrastructure projects are considerably short on funding, and little has been done recently to mitigate the colossal funding gap (The African Capacity Building Foundation 2016). Moreover, infrastructure is crucial for development. From transport systems to power-generation facilities and water and sanitation networks, infrastructure provides the services that enable society to function and economies to thrive. This makes infrastructure the very core of the efforts to meet the Sustainable Development Goals (SDGs). Encompassing every domain from health and education for all to access to energy, clean water and sanitation, most of the SDGs involve improvements in infrastructure.

Energy infrastructure seems to be the most in need of financing in Africa, followed by water and sanitation. Transport infrastructure comes a close third in funding needs (African Development Bank 2018). However, Africa is reportedly performing much better in telecommunications than in any other infrastructure sector, with mobile phone networks reaching 80% of the population (The African Capacity Building Foundation 2016).

While infrastructure stock matters for economic growth, infrastructure quality is also relevant, since high-quality infrastructure raises rates of return on private capital by augmenting productivity and output. Therefore, special attention should be paid to enhancing infrastructure quality, to incentivize production by lowering the cost of capital. The argument here is that infrastructure may improve total factor productivity by lowering input costs or by expanding the production frontier or the set of profitable investment opportunities (e.g., Barro 1990).

Proposal

Fixing Sub Saharan Africa’s infrastructure gap could also help reduce the pressures of rising debt

Africa has made significant progress in reducing poverty and increasing access to education and health services, but the gap in infrastructure services still looms large throughout the region (African Development Bank 2018). The rapid increase of public debt has constrained many countries’ capability to finance infrastructure (IMF 2017). Africa’s infrastructure investment gap has widened with the rapid increase in population, placing more pressure on both social infrastructure (health, education) delivery and the physical infrastructure, mainly roads, because of the considerable shift of people from rural areas to cities in the context of continued urbanization (World Economic Forum 2015).

Investors’ appetite for Africa’s infrastructure has not been significant and reflects the underdevelopment of countries’ institutional structures, besides a lack of complementary domestic financial resources, given the existing budget deficits. African countries face constraints in the access to international capital markets and to rely on lending for infrastructure investment.

The African debt becomes problematic if it is excessive, that is, when borrowing exceeds the capacity of debt financing, as the large debt burden can create both macroeconomic crises and microeconomic stress. Debt can also be detrimental when used in investments that do not have sufficient return rates. Indebtedness in moderate amounts is very necessary to finance much-needed infrastructures, while it allows a smoothing of investment and consumption over time.

Infrastructure projects use up large amounts of national budgets, and hence, need to be well assessed to determine whether past investments were successful. One narrow way to measure this is to check if the realized investment projects are generating sufficient revenues, enabling the country to service the corresponding debt. A broader way to measure an investment’s success is to see if it had a beneficial effect on the population. For example, when building a free access road, we can determine if it improves people’s mobility (reducing transportation duration for merchandise, alleviating school dropout rates, etc.) by reducing indirect costs.

In general, debt problems are a consequence of weak social contracts. When the government invests in the right types of infrastructure, people seem more willing to pay the taxes the government needs to service its debt, strengthening the social contract between government and the population. Furthermore, governments should also exert more effort in domestic revenue mobilization by broadening the fiscal base, fighting tax evasion, and containing tax avoidance.

Addressing the mismatch between developed countries’ “global savings glut” and African countries’ “investment dearth”

One of the major paradoxes of the current times is that the excess savings in many developed countries are not channeled into financing profitable infrastructure projects in Africa. These excess savings create several financial and economic problems, such as inordinately low interest rates in developed countries and the resulting liquidity traps (Canuto and Liaplina, 2017). Meanwhile, investment deficits in Africa are weakening the growth prospects and deepening the population’s economic and social misery. A mutually profitable global transaction can simultaneously address developed countries’ excess savings problem and African countries’ infrastructure funding gap.

On the institutional investors’ side, the decline in interest rates following the 2008 financial crisis generated more awareness of infrastructure’s potential as an alternative class of assets that can reap substantial revenues and help diversify portfolios. However, some sovereign and pension funds still struggle to invest in infrastructure due to either inability or unwillingness (African Development Bank 2018).

Demand for infrastructure-related finance

To design effective tools to channel private investment to infrastructure projects, the special characteristics of infrastructure must be recognized. Some of these are:

- Long-lived assets

- Low technological risk

- High entry barriers (and hence usually strongly regulated assets with predictable and stable revenue streams)

Further, as an overview of the available products to fund infrastructure projects, two generic categories can be identified: project and corporate finance.

- Corporate finance is the traditional channel for infrastructure projects, especially private ones. Firms in charge of the infrastructure (i.e. building and operating projects) either issue shares or borrow in capital markets to obtain the required funding. Such firms tend to have a portfolio of projects. In energy markets, utilities typically have a portfolio of energy projects with various risk profiles.

- Project finance is a relatively recent trend as compared to corporate finance. It builds on the idea that financing does not depend on the creditworthiness of sponsors but only on the ability of the project to repay debt and remunerate capital. In this context, it deals with the financing of a precisely defined economic unit. Typically, because cash flows are more stable, project finance tends to allow a higher level of debt.

A schematic representation of financing alternatives is presented in Table 1; see also (OECD 2015a). The main financing instruments in infrastructure projects are loans and bonds. Debt markets are the deepest markets in the world, and can thus be structured for long-maturity products coherent with the long lives of an infrastructure project. Moreover, such debt instruments may benefit from the existence of players in debt markets with a preference for long-term investments. Insurance companies or pension funds tend to prefer long-maturity products to hedge their long-lived liabilities. Consequently, a large part of the project is typically financed through debt instruments (predominantly loans).

Table 1. Basic financing instruments

Source: Own elaboration based on OECD (2015a, 2015b).

A sizeable part of debt instruments is subordinated debt and, in general, instruments for both project (as mezzanine) and corporate finance have the characteristics of debt and equity (see OECD 2015a for details). Subordinated debt can be perceived as an instrument designed to absorb credit loss before senior debt. Thus, the main effect is that it increases the quality of such senior debt. In that sense, subordinated debt can be designed to have different risk/return ratios, constituting a bridge between traditional debt and equity.

Finally, equity finance may be seen as the risk capital of the project (usually required to begin the project or refinance it). Listed shares would be traded in public markets whereas unlisted shares would provide direct control of the project. Project equity finance may be placed closer to debt instruments in the sense that infrastructure contracts may impose relatively low risk/return ratios. In any case, we understand equity investment as receiving residual claims on cash flows, and is thus the highest-risk investment.

Supply of infrastructure-related finance

The supply-side is the other part of the finance ecosystem. To map it, we may note, as described above, that one important difference is the role of equity in the funding of the infrastructure project. In this context, the kind of offer that can be found depends on the role of equity in the funding of the project.

Hence, we identify two basic modes of governance for infrastructure projects that allow identifying two different environments for the project, which in turn define two different roles for equity. The first mode is conceptualized as being organized around the infrastructure project. In general, this means that the return in the project investment will be associated exclusively with project outcomes (project finance). The second mode of governance is through a company that implements a portfolio of projects. The return on investment in these cases, from a financial point of view, depends on the risks associated with the firm’s portfolio, not just a particular project. This classification means that projects associated with project finance (typically with secured income streams) will allow the unlocking of a greater number of debt instruments.

Equity investors

- Corporates: Corporate may have different profiles (as the role of equity varies) depending on whether they participate in adding the project to their balance sheet or through project finance. Traditionally, utilities have been the main corporates with interest in infrastructure. However, in recent years, with the importance of green infrastructure increasing in various social and political agendas, other investors have become interested in infrastructure investment. A significant move observed in the infrastructure industry is an interest from oil and gas companies in green infrastructure, such as wind offshore, storage, and perhaps carbon capture and storage (CCS).

- Institutional investors: Dedicated funds are growing in importance, but are still not a very relevant part of the investment. Sovereign funds, infrastructure funds, insurance and pension funds, exchange-traded funds, and so on may be a financing source under certain conditions. Nonetheless, these funds are not typically interested in exposures to relatively high risks.

Debt investors

- Commercial banks: Lending from commercial banks has specific constraints. Additionally, it is important to consider that Basel III, while addressing solvency problems in the markets, increased the costs of lending considerably.

- Institutional investors: Institutional investors in this context are similar to those discussed under equity investments. Particularly, insurance and pension funds increase their interest in infrastructure investment as this kind of asset matches their portfolio well.

- Governments and development banks: These institutions have been important sources of finance for infrastructure projects. Moreover, their role has consisted in providing various important functions to improve financial conditions for infrastructure investment, for instance, de-risking of projects, being an early mover in risky undertakings, and so on.

Investing in global infrastructures is a risky business for institutional investors because of infrastructure-specific risks along long project life-cycles. However, such long-term investments can yield real returns. This type of investment is characterized by long periods of construction of facilities. The lengthy periods of construction and the many decades during which the facility is expected to operate is a common characteristic of infrastructure investments. Thus, payment for the produced service should be pegged to inflation. This protects the facility’s revenue stream from fluctuating price levels and ensures a predictable cash flow.

Ideally, direct private investment would be the quickest way to fill unmet infrastructure needs through public–private partnerships (PPP). According to this financing model, governments grant concessions to private entities to finance and construct infrastructure facilities. However, PPPs requires high levels of capital that very few institutional investors can provide by themselves. It would also typically entail partnering with a construction firm or other similar corporates to deliver actual physical assets. Further, even for institutional investors with enough assets for direct investments, evaluating the financial feasibility of infrastructure projects can be difficult, because investors generally lack in-house expertise to assess these.

For smaller institutional investors with little or no experience in infrastructure, asset pooling would be better to increase investing capability. Further, by investing in such infrastructure funds, institutional investors can access unlisted infrastructure even if they lack the internal expertise or resources to assess projects unilaterally.

A more common but even less direct manner of investing is through listed infrastructure. Becoming a shareholder of a publicly listed infrastructure company allows investors to gain exposure to the sector, while enjoying relative liquidity and committing a relatively minimal level of investment. However, a limitation of listed infrastructure products is that they tend to perform similarly to other asset classes, especially equities, as they are exposed to stock market volatility.

Risk mitigation measures to attract private sector financing

One way to mitigate the financial risks stemming from infrastructure projects is to adopt some additional credit enhancement. Infrastructure projects, which require considerable financing amounts and present high financial risks, always require sovereign support in the form of default guarantees. If any political changes or natural disasters compromise a project construction or operation, investors will need to have a recourse in the form of such sovereign guarantees. Government guarantees can also be essential in financing cross-border projects, such as transport infrastructure, which requires specific instruments to cover and meld the varying risks in participating countries. Moreover, credit guarantees can also lower the cost of borrowing by covering losses in the event of a default. Finally, since infrastructure projects are generally financed through foreign debt, special attention should be paid to mitigating currency risks through medium and long-term swap arrangements. However, more should be done to encourage finance from local investors, thus avoiding currency risks at the source.

Overall, infrastructure investors should aim to increase financing from all sources and adopt the right policies to hedge their investments from the possible adverse shocks. It is also essential to adopt a pragmatic strategy to identify the most critical infrastructure projects and programs to support agricultural transformation, industrialization, and modern services through the development of competitive industries in carefully selected geographic zones and fund them adequately. Targeting sectors and locations is therefore crucial to streamline the use of the available financial resources.

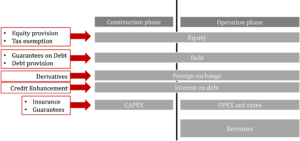

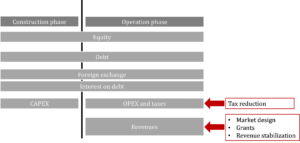

To map the tools that can be designed to improve investment conditions in infrastructure projects, we may think of a typical infrastructure project as comprising of two phases:

- the construction phase, where most of the costs need to be faced and normally no cash flows are obtained, and

- the operation phase, where costs are lower and income streams begin to open, and cash flows become increasingly positive.

The above classification allows identifying two phases with very different risk profiles. The construction phase normally bears all the risks, and the operation phase is normally exposed to less risky cash flows. This is especially true in project-finance type of investments, where income streams are usually agreed upon for the entire life-cycle of the infrastructure before the construction begins.

Thus, we may summarize the tools available to enhance investment conditions as in Figures 1 and 2. In particular, Figure 1 shows the possible tools associated with the construction phase.

Figure 1. Potential financial instruments to mitigate risks.

Source: “Financing the transition to renewable energy in Latin America, the Caribbean and Europe”, EULAC Foundation

Figure 2. Revenue-enhancing instruments to mitigate risks

Source: “Financing the transition to renewable energy in Latin America, the Caribbean and Europe”, EULAC Foundation.

Considering the ecosystem of investors described above, the two figures are intended to show a map of possible functions to be taken by governments and development banks. In particular, they are tools designed to de-risk infrastructure projects and mobilize private investment in infrastructure.

A case study approach for infrastructure financing capacity in sub-Saharan Africa: South Africa, Kenya and Mauritius (The African Capacity Building Foundation (AfCBF) 2016)

The AfDB, OECD, and UNDP (2013) rank South Africa, Kenya, and Mauritius, in that order, as the three African countries with the greatest depth of financial markets. Further, Mauritius and South Africa as the second and fourth best, respectively, in infrastructure development. A survey conducted by the AfCBF on those three countries aimed to establish the capacity issues that may hamper the sourcing of infrastructure finance for various public projects. Hence, as these countries are the best examples of the private sector’s involvement in the region’s infrastructure financing, such a case study may provide evidence of the private sector’s human and financial capacity to meet Africa’s infrastructure needs.

The survey covered several areas of capacity building, including capital markets, human resources, infrastructure spending, and information and communication technology. The main findings for the three countries are the following:

- South Africa emerges as relatively better poised to use its capital markets to finance the country’s infrastructure activities, and with better-qualified and more experienced human resources in the ministries that deal with infrastructure financing and the national Treasury. However, some of South Africa’s regulations governing the PPP process were said to be too complex and needed review. Furthermore, there isapublic perception that PPP processes are riddled with corrupt procurement and that they are beneficial to private partners at the public’s expense. Therefore, a sensitizing effort from governmentsregarding this issue is strongly recommended.

- Kenya is well organized as far as PPPs are concerned, having passed legislation governing the process in 2013 and subsequently establishing a separate PPP Unit under the national Treasury. The Unit, however, has notyetsuccessfully closed a PPP project, although several such projects have been initiated; delays in project closurehave been attributed to the heavy bureaucratic process. The country’s capital markets, although relatively well developed, do not seem ready to provideenoughfinancing to satisfy public infrastructure needs.

- Mauritius perhaps most closely reflects the Sub-Saharan African infrastructure financing capacity constraints, since its capital market is thin. Within its PPP framework, Mauritius has not been able to partner with the private sector on any project. The two projects that were recently floated under the PPP framework could not mustersufficientprivate sector interest and were consequently shelved. Mauritius also seems to be seriously lacking in human resource capacity, with ministerial staff said not topossess several critical skills that can enable the smooth functioning of their infrastructure dockets.

We believe that the points raised above outline an agenda that can be followed to lift infrastructure investment finance in Africa. The payoff in terms of economic growth and poverty reduction make it well worth pursuing.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

The African Capacity Building Foundation. 2016. “Infrastructure development and financing in sub-Saharan Africa: Toward a framework for capacity enhancement.” Occasional Paper No 25: Sayeh, A.

African Development Bank. 2018. African economic outlook 2018: Macroeconomic developments and structural change: Infrastructure and its financing. Abidjan: African Development Bank.

Barro, Robert J. 1990. “Government spending in a simple model of endogenous growth.” Journal of Political Economy 98, no. S5: 103–125.

Canuto, Otaviano, and Alexandra Liaplina. 207. “Matchmaking Finance and Infrastructure.” Policy Brief PB 17/23. Rabat: Policy Center for the New South.

The Economist Intelligence Unit. 2019. The critical role of infrastructure for the Sustainable Development Goals.

Foster, Vivien, and Cecilia Briceño-Garmendia. 2010. Africa’s Infrastructure: A Time for Transformation. Washington, DC: World Bank.

Gurara, Daniel, Vladimir Klyuev, Nkunde Mwase, Andrea Presbitero, Xin Cindy Xu, and Geoffrey Bannister. 2017. “Trends and Challenges in Infrastructure Investment in Low-Income Developing Countries.” IMF Working Paper.

Kodongo, Odongo, Kalu Ojah. 2016. “Does infrastructure really explain economic growth in Sub-Saharan Africa?” Review of Development Finance 6(2): 105–125.

OECD. September 2015. “Towards a framework for the governance of infrastructure”. Public Governance and Territorial Development Directorate Public Governance Committee

OMFI Special Report. 2019. Infrastructure and Real Estate.

Sayeh, Antoinette M. 2014. “Infrastructure Investment: Part of Africa’s Solution.” IMF Blog. October 28, 2014. https://blogs.imf.org/2014/10/28/infrastructure-investment-part-of-africas-solution/

World Economic Forum. 2015. “The risks of rapid and unplanned urbanization in developing countries.” Zurich. January 14, 2015. https://www.zurich.com/en/knowledge/topics/global-risks/the-risks-of-rapid-urbanization-in-developing-countries

This Post Has One Comment

Hi, Otaviano

It’s Ester Dal Poz, from unicamp.

I would like to talk to you, but your World Bank mail address does not work anymore…and I do not have your new one.

Can you please make contact?

esterdal@unicamp.br

Best,

Ester

Comments are closed.