Canuto, O., Ribeiro dos Santos, T. “Economic effects of the Brazilian constitution”, Novos Estudos CEBRAP, v.37, n.3, p.417‑426, September-December 2018. (see original here)

The goal of this article is to examine the economic effects of some provisions on the Federal Constitution of Brazil. The Constitution of Brazil is one of the longest and most detailed constitutional texts in the world. We find that both because of the specific provisions of the text, but also by the political economy implications of the sheer length, the Brazilian Constitution tends to increase governmental spending.

“You mean the text, right?” That’s reportedly how one of the main scholars of constitutions, Walter Murphy, always started a conversation on the topic. It makes sense. The word “constitution” has two substantially different meanings, but these are often confused because of their connection. The constitution of a country can be understood as the set of rules which organize the activity of the state: how the Judiciary works, whether and how elections are conducted, what kind of head of state they have. Or it may simply mean the totality of the text which a given country has chosen to label so. Most often these two meanings are strictly connected: the constitutional document is essentially the set of rules organizing the states. But not too rarely they diverge. The United Kingdom definitely has a constitution, but British law does not name any document that way. Brazil, on the other hand, has such a document, but it deals with many more issues than the organization of the state. So, to be clear, in our case, we do mean the text. The goal of this article is to examine the economic effects of some provisions on the Federal Constitution of Brazil.

We will have to make choices. Any constitution will affect economic outcomes in many ways. Persson and Tabellini (2003) dedicate an entire book to the economic effects of a few central, but very specific provisions. Considering that the Constitution of Brazil is the third longest in the world (Comparative Constitutions Project, 2016) and “attempt[s] to constitutionalize nearly every aspect of public life” (Elkins et al, 2009), a thorough examination is impossible. Instead, we will concentrate on some of the aspects we believe impact the economy of Brazil the most, in particular topics: pensions; education; health; and taxes. In conclusion, we will consider the recent fiscal trends in Brazil following the approval of the constitutional text.

- The pension system

The pension system is one of the issues awarded much greater detail in the Brazilian Constitution than its counterparts. While most texts will essentially affirm that there shall be a pension system, or perhaps not mention social security at all, most of the main aspects of the Brazilian pension system appear in the constitutional text, in a specific section, under Chapter II (“Social Security”) of Title VIII (“Of the Social Order”). Some provisions merit our attention: (a) the “pay-as-you-go system”; (b) the lack of minimum age; and (c) the prohibition on reducing benefits.

- “Pay as you go”

Brazil adopts a pay-as-you-go system. This means that pension benefits are paid from the pension system revenues of the same period. If pension revenues cannot cover predetermined benefits, the Brazilian Treasury must pay the difference. An alternative model is the “fully-funded” system, adopted in countries like Chile. This system allocates contributions in special funds, which invest the resources in the market until the payment of benefits. In this case, pension system deficits cease to alarm—giving way to concerns about the solvency of the funds. If investments do not pay off as expected, the amount of benefits must decrease.

Economists tend to believe that a fully-funded system is more attractive than its pay-as-you-go counterpart, for two main reasons: first, rates of return on investment usually exceed the rate of growth of economies. Pensions funded through a fully-funded scheme may, in equilibrium, benefit pensioners more than a pay-as-you-go system. Second, a fully-funded system retains incentives for productive labor, since benefits relate more directly to contributions. From a political economy point of view, a fully-funded system offers the advantage of a clearer source of financing, so that demographic variations do give rise to intergenerational conflicts. Empirical studies favor the hypothesis that fully-funded schemes have a positive effect for growth (Bijlsma, van Ewijk, and Haaijen, F., 2014).

- Lack of minimum age

Article 207, §7 of the Federal Constitution determines the conditions for workers’ retirement:

I – thirty-five years of contribution, if a man, and thirty years of contribution, if a woman;

II – sixty-five years of age, if a man, and sixty years, if a woman; this age limit being reduced by five years for rural workers of both sexes and for those who exercise their activities within a household system, therein included rural producers, placer miners, and self-employed fishermen.

Despite divergent opinions from legal scholars such as Ives Gandra Martins (1999), the prevailing interpretation is that those are alternative conditions, not cumulative; workers are entitled to benefits if either is met.

Workers have an incentive to retire as soon as possible, given that Brazil adopts a system with benefits that are largely independent of the amount of contributions. Most countries adopt a minimum age of retirement to deal with this issue—typically between 60 and 65 years of age. Without a minimum age, average retirement age in Brazil is 58, while in the OECD countries it stands at 64. Early retirements are twice a cost: not only do they imply payments for a longer time, they also disincentive the work of some of the most productive members of the workforce. Early retirees could instead contribute substantially to older beneficiaries.

- Irreducibility of the value of benefits

Article 194, IV of the Federal Constitution determines that the value of benefits cannot be reduced. There is no guarantee, however, that the amount of resources provisioned for pensions will be enough to cover costs. The irreducibility rule effectively proscribes a correction for ballooning expenses absent a constitutional amendment. Even an extremely undesirable correction through inflation would violate the Constitution. Article 201, paragraph 4 establishes that “Readjustment of the benefits is ensured, to the end that their real value is permanently maintained, in accordance with criteria defined by law.”

Irreducibility aims at protecting, quite literally, grandfather rights. But it prevents the adoption of more equitable and transparent rules, which could avoid the deterioration of the fiscal situation. An example of such a rule is a ceiling on pension expenses as a percentage of Brazilian GDP with automatic and equal proportional cuts if the ceiling would be exceeded. Any major reform of the pension system which preserved the irreducibility principle would impose enormous costs on younger generations and no costs whatsoever on older generations.

Fast aging increases the challenge

The population of Brazil is aging rapidly. While the French took almost 150 years to go from 10% to 20% of persons over 60 in their population, and the British took 65 years, Brazilians will do it in only 25 years—between 2010 and 2035 (Canuto, 2017). That means a very accelerated increase in the “elderly dependency ratio” (the proportion of people over 65 to people of working age). The dependency ratio was around 10% in 2010, and the Brazilian Geographic and Statistic Institute (IBGE) estimates that it will be around 45% in 2060. Workers’ burdens in a pay-as-you-go system will be dramatic.

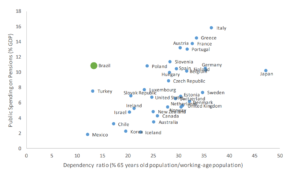

The fiscal effects of current pension rules are already being felt when the total dependency ratio of the Brazilian population (which includes youth under 20 for the calculation) is at a historic low of 44%, according to the World Bank. As one of us has written, Brazil spends much more with pensions than other countries (Canuto, 2017). Japan is the recurrent example. The Asian country spends the same with pensions as a proportion of GDP as Brazil, but has a much larger elderly dependency ratio. The comparison is not completely fair, however, since Japan is an outlier in the opposite direction. Still, a quick look at the graph below, by the World Bank, reveals how far Brazil is from the very clear line that relates the dependency ratio with public spending on pensions.

Chart 1 – Total Pension Spending (RPPS and RGPS) as a Share of GDP and Dependency RatioSource: World Bank – “Summary Note on Pension Reform in Brazil: Why is it Needed and What Will be its Impact?”

- Education

Human capital formation is one of the most important factors for economic development, and education brings a number of noneconomic benefits. This leads many governments to inscribe the promotion of education in their constitutions. Few, however, specify how this promotion will happen as much as the Brazilian constitution. Former Minister of Education Cristovam Buarque is one of the most vocal critics of what he sees as an excessive detailing which hinders experimentation and innovation in educational practices. If these critics are correct, then the current rules may be negatively affecting Brazilian development. We will, however, focus on a rule with more direct effects: minimum spending on education.

Article 212 stipulates that “[t]he Union shall apply, annually, never less than 18%, and the states, the Federal District, and the municipalities, at least 25% the tax revenues, including those resulting from transfers, in the maintenance and development of education.” There is scant evidence that spending is related to educational outcomes. Brazil is an example of that: while the country spends more on education as a percentage of GDP than the OECD members on average, its PISA results are at the bottom of the ranking—63rd out of 70 countries.

All municipalities must spend the minimum 25% of resources, independently of any of their underlying characteristics such as size (which could make them more efficient in education and demand less resources) or share of youth. Considering the fast aging of the population, discussed above, the amount spent on education will continue to grow without expectation of better results. This is not necessarily a correction. Contrary to popular opinion, Brazilian teachers earn similarly to their counterparts in peer countries at entry, and significantly more after promotions. They also benefit from a more generous pension scheme than teachers in other countries (World Bank, 2017b).

- Health

As with other subjects, health has a much longer treatment in the Brazilian constitution than in others, and, as in the case of education, there is a minimum level of expenses. In this case, however, there does not seem to be as many distortions derived directly from the Constitution[1]. Choosing a model of healthcare always involves trade-offs, and the decision must consider market failures, information asymmetries, adverse selection and externalities. In light of those challenges, the Brazilian choice for a government-provided system is appropriate and follows the model of some of the most successful healthcare systems around the world. The minimum spending rule also has not been a problem because it has not been binding for the past years. Even so, public spending at 4% of GDP lies below the OECD average of 6% and is comparable to countries like Colombia and Mexico. Given the fast aging mentioned above, we should expect that health will demand even more resources. In this sense, the constitutional minimum is not currently binding, nor should it be soon.

- Taxes

The Brazilian constitution determines the competencies to tax for the different federal units. The Union, the states and municipalities get their revenues from the activities specified in the constitutional text, and there is no freedom to establish taxes on anything other than what is stipulated. The table below brings a list of different taxes in the constitution (adapted from Pontes Lima, 1999):

| Taxes on income | Taxes on consumption | Property taxes | Other | |

| Federal | i. Income tax (art. 153, III)

– Personal income – Corporate income ii. Social contribution on net profits (art 195, I,c) iii. Social Security contribution (art. 195, I, b) |

i. Industrialized product taxes (art 153, IV)

ii. Import taxes (art 153, I) iii. Export taxes (art 153, II) iv. Financial operation taxes (art 153, V) v. PIS/PASEP contribution (art. 239) |

i. Tax on rural property (art. 153, VI) | a. Taxes on labor

i. PAYG contributions (art 195, II) ii. Contribution for “education-wage” (art 211, par 5) b. Contributions of economic domain intervention (art. 149) i. CIDE ii. FGTS |

| State | i. Tax on trade and services (art 155, II)

|

i. Tax on motorized vehicles (art 155, III)

ii. Tax on donations and estates (art 155, I) |

||

| Municipal | i. Tax on services (art. 156. III) | i. Tax on urban real estate (art 156, I)

ii. Tax on real estate transmission (art 156, II) |

There is a clear violation of lesson 6 of Mankiw et al (2009)’s lessons in optimal taxes: “Only final goods ought to be taxed, and typically they ought to be taxed uniformly.” First, there is no concern regarding the stage of production for taxation purposes—which means that inputs are taxed at the same rate as final goods, with consequences for value added chains. Second, the constitutional division of competencies for different kinds of goods and services, with rates defined by different federation entities, makes it almost certain that there will not be uniformity in taxes.

“This complexity jeopardizes the Brazilian business environment by increasing the amount of misallocation of resources, which can represent a very important drag in productivity”. Hsieh and Klenow (2009) estimate that 30-60% of the productivity difference of countries such as India and China to the United States is due to misallocation, and Stefanski and Toews (2018), in turn, estimate that differences in tax policies are the greatest contributor for this misallocation.

- Consequences of a particularly long text

The relative length of the Brazilian constitution has been debated since its draft phase, and will certainly be subject to discussion in other articles in this volume. In this text, the analysis will be restricted to the economic effects of that greater relative length.

There is sparse literature on the economic effects of detailed constitutions. Constitute Project, which is dedicated to the comparative study of constitutions, considers the effects of length on constitutions duration, but not their economic effects. What has been more studied is the economic effects of supermajorities and, given that the Brazilian Constitution is subject to amendments only when supermajority requirements are met, we will explore that literature.

Economist James Buchanan believed that supermajorities would have the effect of limiting the scope of the state, since only measures with wide acceptance would be approved. Based on this logic, many American states adopted supermajority requirements during the XX and XXI centuries. This has allowed for studies which empirically explore the variation on supermajority rules on government expenses.

Studies such as “Supermajority Voting Requirements for Tax Increases: Evidence from the States”, by Brian G. Knight and “Majority Rule versus Supermajority Rules: Their Effects on Narrow and Broad Taxes” by Jac C. Heckelman and Keith L. Dougherty support Buchanan’s hypothesis. While Knight’s article finds a global reduction in taxes, Heckelman and Dougherty point at a reduction only in narrow base taxes, but not a reduction in overall taxes.

Lee (2014), however, finds what he calls the “paradox of supermajority rule”: supermajority requirements for tax increases, aimed at limiting governmental expenses, would ultimately increase expenses. According to his model, this result is expected if politicians are trying to promote private goods (meaning rival and excludable) to their constituencies. With a simple majority rule, a politician with the capacity to distribute some benefit needs only to gather 50% of his colleagues. With a supermajority, this requirement is higher. Consequently, both a raise in taxes and more “pork barrel” expenses are approved.

Lee’s empirical analysis finds evidence in favor of his hypothesis of higher expenses. In effect, a closer reading of Heckelman and Dougherty’s findings reveals statistically significant positive effects of supermajority rules and broad taxes. Because they lacked the theoretical basis for such an effect—as provided by Lee—Heckelman and Dougherty do not pay much attention to that effect.

The very broad scope of the Brazilian Constitution gives ample room for transactional behavior among Congress members. Alston and Mueller (2006) find evidence of such behavior in the period they studied, the mandate of Fernando Henrique Cardoso and the beginning of the first mandate of Luiz Inácio Lula da Silva.

Conclusion

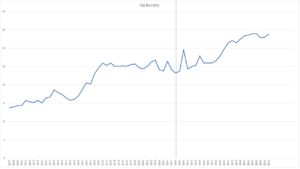

Since the approval of the Constitution, spending has increased constantly (Canuto, 2016) (Almeida, Lisboa and Pessoa, 2015). In 1991, the tax burden amounted to 25% of the GDP; in 2016, 32% of the GDP. Expenses, however, increased at an even faster pace—generating recurrent deficits and the ongoing fiscal crisis. Central government expenses (which include the federal government, the Brazilian Central Bank and the Social Security National Institute – INSS) are the main driver of that growth. Pension spending has increased 4.3 percentage points between 1991 and 2014, and now account for 13% of GDP.

The data suggests that the effect of the constitution could be strong. From the graph below, we see that the tax burden remained mostly constant during the years immediately prior to the Constitution, and then had a steep rise:

Source: Fundação Getúlio Vargas and IBGE.

The Brazilian Constitution was drafted in an environment of remarkable optimism about its power, combined with deep suspicion of abrupt changes without wide support, after more than twenty years of dictatorship. Both the optimism and the suspicion acted together to promote the inscription of an extensive list of services which should be paid by the state. There was not, however, a well-thought plan on how all of these services would be financed without suffocating the administration. The text differentiates itself from other constitutions in its length and specificity. These characteristics will present a strong challenge to the sustainability of the Constitution as it is in the coming years.

Otaviano Canuto is Principal at the Center for Macroeconomics and Development and a former Executive Director for Brazil, Colombia, Dominican Republic, Ecuador, Haiti, Panama, Philippines, Suriname, and Trinidad & Tobago at the World Bank.

Tiago Ribeiro dos Santos is a career diplomat for Brazil acting as advisor to the Executive Director for EDS15 at the World Bank.

The opinions expressed here are solely of the authors and do not express the views of the institutions to which they are affiliated.

[1] As the “A fair adjustment” document shows, however, there are several inefficiencies in the health sector, most notably the subsidies given to private insurance plans, but these are not directly related to the constitutional text.

References

Almeida, Mansueto; Lisboa, Marcos de Barros; Pessôa, Samuel. “Ajuste inevitável”. Folha de S.Paulo, 19 jul. 2015.

Alston, L.J.; and B. Mueller. “Pork for Policy: Executive and Legislative Exchange in Brazil.” Journal of Law Economics and Organization 22: pp. 87–114, 2006.

Bijlsma, M.; van Ewijk, C.; Haaijen, F. “Economic Growth and Funded Pension Systems.” (Netspar Discussion Papers; no DP 07/2014-030). Tilburg: Netspar, 2014.

Canuto, O. “What’s Ailing the Brazilian Economy?”, Capital Finance International, fall issue, 2016, accessed December 3, 2018, http://cfi.co/finance/2016/11/otaviano-canuto-world-bank-whats-ailing-the-brazilian-economy/.

_________. “Brazil’s Pension Reform Proposal Is Necessary and Socially Balanced”, International Association of Financial Management – INTERFIMA, 2017, accessed December 3, 2018, http://www.interfima.org/publications/brazils-pension-reform-proposal-necessary-socially-balanced/.

Comparative Constitutions Project, CCP Rankings, http://comparativeconstitutionsproject.org/ccp-rankings/

Constitution of the Federative Republic of Brazil: constitutional text of October 5, 1988, with the alterations introduced by Constitucional Amendments no. 1/1992 through 64/2010 and by Revision Constitutional Amendments no. 1/1994 through 6/1994. – 3rd ed. – Brasília: Chamber of Deputies, Documentation and Information Center, 2010.

Elkins, Z.; Ginsburg, T.; Melton, J. The Endurance of National Constitutions. Cambridge: Cambridge University Press, 2009.

Fundação Getúlio Vargas – Centro de Contas Nacionais – several publications, from 1947 to 1989; IBGE. Diretoria de Pesquisas. Coordenação de Contas Nacionais, at https://seriesestatisticas.ibge.gov.br/series.aspx?vcodigo=SCN49

Gandra da Silva Martins, Ives (1999). Aposentadoria – Inteligência do parágrafo 7º do artigo 201 da Constituição Federal – Opinião Legal, 1999, accessed December 3, 2018, http://www.gandramartins.adv.br/project/ives-gandra/public/uploads/2014/10/28/337deeb040699p.doc

Heckelman, Jac C.; Keith L. Dougherty (2010). “Majority Rule versus Supermajority Rules: Their Effects on Narrow and Broad Taxes”, Public Finance Review 38: p.738–61.

Hsieh, Chang-Tai and Peter J. Klenow (2009). “Misallocation and Manufacturing TFP in China and India,” Quarterly Journal of Economics, 2009, 124 (4), p.1403–48.

Knight, Brian G., “Supermajority Voting Requirements for Tax Increases: Evidence from the States”, Journal of Public Economics, 76(1), 2000.

Persson, Torsten; Tabellini, Guido. The Economic Effects of Constitutions. Cambridge and London: MIT Press, 2003.

Pontes Lima, Edilberto Carlos. “Reforma Tributária no Brasil: entre o ideal e o possível”. Text for discussion nº 666. Ipea, 1999, accessed December 3, 2018, http://www.ipea.gov.br/portal/index.php?option=com_content&view=article&id=4179

Stefanski, Gerhard; Toews, Radoslaw. What’s in a Wedge? Misallocation and Taxation in the Oil Industry. Unpublished manuscript, 2018.

Mankiw, N. Gregory; Weinzierl, Matthew; Yagan, Danny. “Optimal Taxation in Theory and Practice,” NBER Working Papers 15071, National Bureau of Economic Research, Inc., 2009.

World Bank. A Fair Adjustment: Efficiency and Equity of Public Spending in Brazil : Volume I: summary (Portuguese). Washington, D.C.: World Bank Group, 2017a. Also available at http://documents.worldbank.org/curated/en/884871511196609355/Volume-I-síntese

__________. Summary Note on Pension Reform in Brazil: Why Is It Needed and What Will Be its Impact?, 2017b. Also available at http://documents.worldbank.org/curated/en/552181491971723170/Summary-note-on-pension-reform-in-Brazil-why-is-it-needed-and-what-will-be-its-impact

Published by Novos Estudos CEBRAP, v.37, n.3, p.417‑426, September-December 2018. (see original here)

This Post Has 2 Comments

Pingback: Fim de ano – Evidente

The economic effect of Braziliam constituition will have it is expected effects and by my side I should say that “is an great example for Angola too”, by changing it is constituition too! Brave Braziliam Government!

Comments are closed.